Sukuk are one of the most commonly used instruments in Islamic finance.

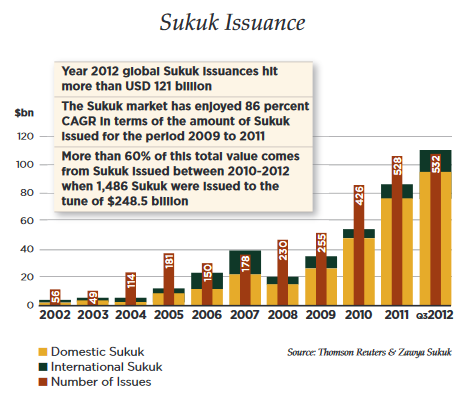

They are also the vehicle behind some of the most dramatic growth seen in the capital markets in recent years. Government and corporate issues from both Islamic and other countries have driven the rapid growth of Sukuk.

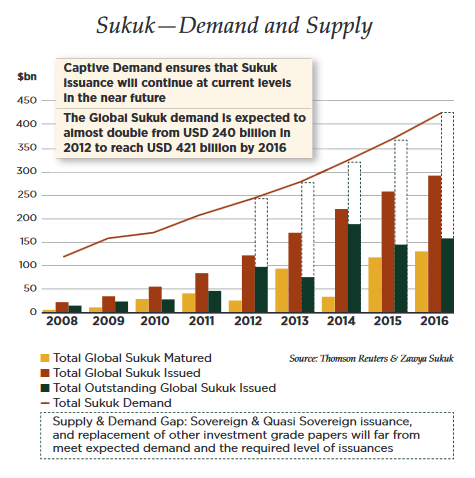

Global sukuk demand is expected to grow from $240 billion in 2012 to $421 billion by 2016. General Electric, Goldman Sachs and the World Bank have all issued sukuk. Major financial firms like PIMCO and Fidelity are active participants in the sukuk market.

INTRODUCTION

Sukuk are sometimes referred to as Islamic bonds.

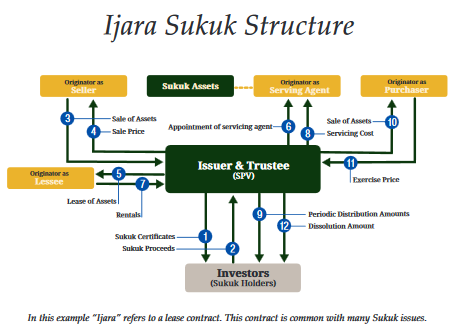

They are structured to avoid the Islamic prohibition on interest. Generally speaking, this is done by paying sukuk holders with the cash flows generated by specific assets, which are put into a special-purpose vehicle, or SPV. Most sukuk are bought and sold in the over-the-counter (OTC) market, where potential yields, maturities, and risk factors affect price.

Like conventional bonds, rating agencies rate sukuk based on their credit quality and the issuer’s ability to pay investors. Sukuk receive ratings that look exactly like conventional bonds.

Sukuk demand is broadly driven by three major investment groups – participants in the Islamic capital markets, socially conscious impact investors who can identify specific projects for investment, and financial intermediary investors looking for opportunities to gain access to sukuk credits for exposure to both an alternative asset class and emerging markets.

This white paper examines three key issue areas concerning sukuk:

- General sukuk structure

- Differences between sukuk and conventional bonds

- Pros and cons of sukuk investing

GENERAL SUKUK STRUCTURE

The Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) defines sukuk as:

Certificates of equal value representing undivided shares in ownership of tangible assets, usufruct and services. Usufruct refers to the right to earn profit from property owned by another person or property that has common ownership (e.g., real estate).

There are different types of sukuk. Some trade at a price approximating par value, while others do not.

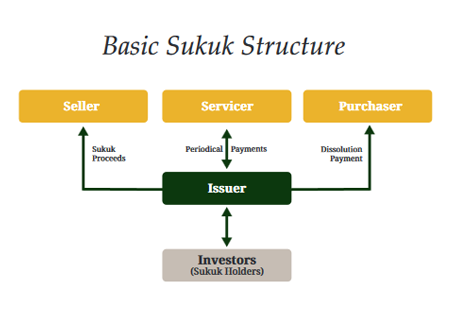

Depending on the type of sukuk, numerous contracts and parties are involved in the issuance process, but generally speaking, any sukuk structure involves three main parties: obligator, issuer, and sukuk certificate holder. The obligator is the government or corporate entity that intends to benefit from the sukuk issuance. The issuer, called the special purpose vehicle (SPV), acts as the middleman between obligator and sukuk holder. These certificate holders range from individuals to sovereign wealth funds to pension plans.

An optional fourth party, the underwriter, is sometimes involved in a sukuk issue. Unlike conventional bonds, however, an underwriter does not usually conduct the actual issuance and is not required in every situation. However, an underwriter may be brought in as insurance to the SPV and guarantee that any unsold sukuk will be purchased. HSBC Amanah, CIMB Investment Bank and Standard Chartered Bank are most often the underwriters for sukuk.

ABOUT THE ISSUER

In a typical sukuk issuance, the obligator creates an SPV to acquire the sukuk’s underlying assets on behalf of investors. The SPV is a legal entity separate from the obligator. It manages the pool of assets related to the sukuk. It is created to transfer ownership of the asset, project, or business because it is not possible to transfer ownership directly to individual sukuk holders. The SPV takes legal ownership of the assets on which the sukuk are based.

The SPV serves as a bankruptcy remote entity involved in purchasing and funding the assets, project, or business. With conventional finance, this entity is typically a firm used to keep the financial risk of large projects separate from the financial risk of the business itself. Should something happen to the sukuk originator, the SPV is not affected because it is a separate entity. Creditors or parties to whom the originator owes money cannot claim the assets of the SPV.

The SPV is an intermediary between investor and obligator. As such, an intermediary adds costs to the transaction. In order to minimize costs, the SPV is expected to be both tax-efficient and capital-efficient, providing the best service possible for the least amount of money. SPVs are typically registered in tax-efficient jurisdictions such as Bahrain, Luxembourg, and the Cayman Islands.

It is important to note that an SPV is not a subsidiary of the originator. An originator establishes an SPV as a separate legal entity that cannot hold any assets other than those used for sukuk issues. As a result, SPVs have minimum capital and few staff members.

Did you know? “Sukuk” is the plural form of the Arabic word “sakk,” which means “certificate.” Some linguists say that the English word “check” is derived from “sakk.”

Evidence of the sukuk’s compliance with Islamic investing principles must be included in the prospectus. Typically, the obligator must obtain and document an independent board of Islamic scholars, in addition to approval from the obligator’s own board. In a few jurisdictions such as Malaysia, the council or board of the legislative or regulatory authority confirms that sukuk comply with Islamic principles.

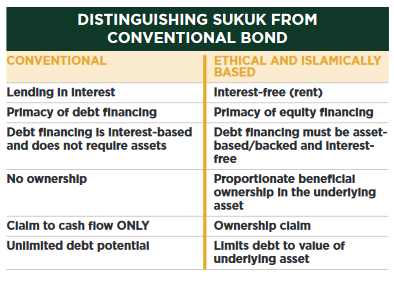

DIFFERENCES BETWEEN SUKUK AND CONVENTIONAL BONDS?

Sukuk are sometimes referred to as “Islamic bonds.” In reality, sukuk are an alternative to conventional bonds. The two products differ significantly, but the term “bond” is often used in relation to sukuk to illustrate the fact that sukuk offer a claim to periodic payments like bonds and that sukuk offer investors a way of diversifying their portfolios just as bonds do.

Modern sukuk emerged to fill a gap in the global capital market. Many Muslim investors wanted to balance their equity portfolios with bond-like products. Because sukuk are asset-based/-backed securities—not debt instruments, which are prohibited according to Islamic investment principles—they met this unfulfilled demand. From there, sukuk have grown to serve as an important part of Islamic and conventional portfolios.

Early evidence indicates that sukuk and bonds do not correlate over longer time periods. Because of this, sukuk are increasingly considered to be an alternative asset class to both bonds and equities.

Each Sukuk has a face value based on the value of the underlying asset. An investor may pay that amount or (as with a conventional bond) buy it at a premium or discount. With sukuk, the future cash flow from the underlying asset is transferred into present cash flow. Sukuk may be issued for existing assets or for assets that will exist in the future.

Investors who purchase sukuk are rewarded with a share of the profits derived from the asset. Unlike conventional bonds, they do not earn interest payments.

Sukuk are issued with specific maturity dates. When the maturity date arrives, the sukuk issuer buys them back from the SPV (See “General Structure” for more information on SPVs). With sukuk, however, the initial investment is NOT guaranteed. The sukuk holder may or may not get back the entire principal amount. This is because sukuk certificate holders share the risk of the underlying asset. If the project or business on which sukuk are issued does not perform as well as expected, the sukuk investor must bear a share of the loss.

Although sukuk are generally repurchased based on the net value of the underlying assets or at a price agreed upon at the time of the Sukuk purchase, some sukuk are issued with repurchase guarantees.

PROS AND CONS OF SUKUK INVESTING

As with any investment, there are advantages and challenges. Because sukuk payments can be structured in a way that is similar to the interest and principal payments on a conventional bond, traditional fixed-income investors find sukuk familiar from a cash flow perspective. But they should not confuse Sukuk for conventional bonds. As noted above, there are several unique features of sukuk investing—complete with their own risk-reward profiles.

ADVANTAGES

The structuring of sukuk is a rigorous process overseen by several stakeholders who review each proposed issuance to ensure that the tenets of Islam are not violated in any way. This ensures that sukuk do not finance any activity considered harmful to the society. As a result, the sukuk structuring process can be seen as having a kind of built-in due diligence process that should be appealing to institutional and impact investors alike.

In addition, sukuk seem well-suited for socially conscious investors because they provide a high degree of certainty that invested monies will be used for a specific purpose. In order to comply with the underlying principles of Islam, the funds raised through the issuance of sukuk must be applied to investment in identifiable assets or ventures. Therefore, if a sukuk issuance is structured to provide funds to a specified project appealing to SRI investors, there is little chance that investor money will be diverted and used for another purpose.

CHALLENGES

One commonly cited issue facing sukuk is “enforceability risk.” Many sukuk contracts are governed by English law but refer to assets located in other countries. This can create challenges in the event of a default. Another potential issue is “Shari’ah risk,” or the possibility that an investment may be found incompliant with Islamic investment guidelines and legal action could be taken.

Of course, these problems are not unique to Islamic finance. Enforceability is an issue in any cross-border transaction. And the objection that a counterparty lacks the legal capacity to engage in a transaction is not unknown in conventional finance. But combined with a general lack of understanding about Islamic finance and misplaced stigmas surrounding the notion of Shari’ah-compliant financing, these challenges should be taken into consideration.

Due to their unique risk-reward profile and their potential as alternatives/complements to traditional capital structures, investors should continue to expect healthy growth in this new industry space as conventional bond issuers adopt the sukuk financing model.

Note: Information contained in this publication is not intended to replace specific advice or recommendations by your investment advisor. It is not intended to provide tax, legal, insurance or investment advice, and nothing in this publication should be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security. Unless otherwise specified, you alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. Asset allocation and diversification cannot guarantee a profit or insure against a loss. There is no guarantee that any investment strategy will be successful; all investing involves risk, including the possible loss of principal. You should consult an attorney or tax professional regarding your specific legal or tax situation. Please check with your advisor for more information: 888.86.AZZAD or www.azzad.net.

Investments are not FDIC insured, nor are they deposits of or guaranteed by a bank or any other entity, so you may lose money. Azzad does not guarantee that your investment objectives will be achieved. Past performance cannot guarantee future results. Azzad only transacts business where it is properly registered or notice filed, or excluded or exempted from registration requirements. The Ethical Wrap Program is made available through an Investment Advisory Agreement and the firm’s ADV PartII brochure. The Azzad mutual funds are available by prospectus only. To request a free copy including other important disclosure information, please call 888-862-9923, 8/2013©.