There’s nothing complicated about common investing techniques, and it usually doesn’t take much time to understand the basics. The biggest risk you face is not educating yourself about which investments may be able to help you achieve your financial goals. Use this resource to get started today.

Why do so many people never obtain the financial independence that they desire? Often it’s because they don’t take the first step—getting started. Besides procrastination, other excuses people make are that investing is too risky, too complicated, too time consuming, and only for the rich.

The fact is, there’s nothing complicated about common investing techniques, and it usually doesn’t take much time to understand the basics. The biggest risk you face is not educating yourself about which investments may be able to help you achieve your financial goals and how to approach the investing process. This paper offers some helpful guidance.

SAVING VERSUS INVESTING

Both saving and investing have a place in your finances. However, don’t confuse the two. Saving is the process of setting aside money to be used for a financial goal, whether that is done as part of a workplace retirement savings plan, an individual retirement account, or some other savings vehicle. Investing is the process of deciding what you do with those savings.

Some investments are designed to protect your principal—the initial amount you’ve set aside—but may provide relatively little or no return. Other investments can go up or down in value and may or may not pay interest or dividends. Stocks, Islamic bonds, precious metals, and real estate all represent investments. Mutual funds are a way to purchase bundles of these investments in one place and also are themselves a kind of investment.

CAUTION: Before investing in a mutual fund, carefully consider its investment objectives, risks, charges, and fees, which can be found in the prospectus available from the fund. Read the prospectus carefully before investing.

WHY INVEST?

You invest for the future, and the future is expensive. For example, because people are living longer, retirement costs are often higher than many people expect. Though all investing involves the possibility of loss, including the loss of principal, and there can be no guarantee that any investment strategy will be successful, investing is one way to try to prepare for that future. You have to take responsibility for your own finances, even if you need expert help to do so.

Government programs such as Social Security will probably play a less significant role for you than they did for previous generations. Corporations are switching from guaranteed pensions to plans that require you to make contributions and choose investments. The better you manage your dollars, the more likely it is that you’ll have the money to make the future what you want it to be.

MUTUAL FUND INVESTING CHECKLIST

Before investing in a mutual fund, you should get and read the prospectus carefully to ensure that you understand exactly what you’re investing in. Here are some of the key factors to consider before investing:

| FACTORS TO CONSIDER | WHY THEY MATTER |

| What is the fund’s objective? | There are three general investing goals: capital appreciation, income, and protection. |

| What’s the turnover ratio? | A fund that trades frequently may generate high taxable capital gains. |

| What’s the expense ratio? | Knowing a fund’s expense ratio—what you pay for the fund’s annual operating costs—can help you judge whether it runs efficiently. |

| What type and level of risk does this fund involve? | A fund’s prospectus must contain detailed information about the types of risks to which investors are exposed. |

WHAT’S THE BEST WAY TO INVEST?

- Get in the habit of saving. Set aside a portion of your income regularly. Automate that process if possible by having money automatically put into your investment account before you have a chance to spend it.

- Invest so that your money at least keeps pace with inflation over time.

- Don’t put all your eggs in one basket. Though it doesn’t guarantee a profit or ensure against the possibility of loss, having multiple types of investments may help reduce the impact of a loss on any single investment.

- Focus on long-term potential rather than short-term price fluctuations.

- Ask questions and become educated before making any investment.

- Invest with your head, not with your stomach or heart.

BEFORE YOU START

Organize your finances to help manage your money more efficiently. Remember, investing is just one component of your overall financial plan. Get a clear picture of where you are today.

What’s your net worth? Compare your assets with your liabilities. Look at your cash flow. Be clear on where your income is going each month. List your expenses. You can typically identify enough expenses to account for at least 95 percent of your income. If not, go back and look again. You could use those lost dollars for investing. Are you drowning in credit card debt? If so, pay it off as quickly as possible before you start investing. Every dollar that you save in interest charges is one more dollar that you can invest for your future.

Establish a solid financial base: Make sure you have an adequate emergency fund and a realistic budget. Also, take full advantage of benefits and retirement plans that your employer offers.

UNDERSTAND THE IMPACT OF TIME

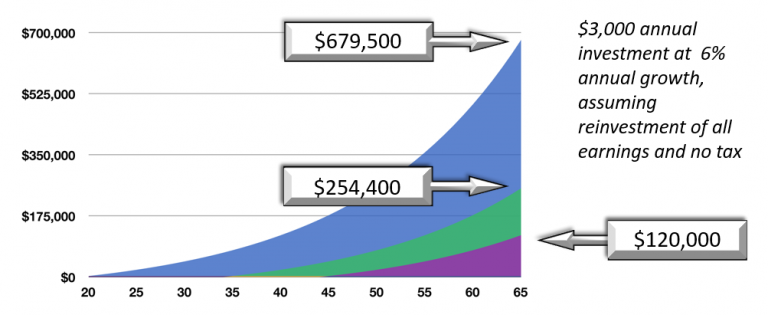

Compounding is the money you make from the reinvestment of income. Be sure to take advantage of it. For instance, let’s say you invest $3,000 at the end of each year beginning at age 20. If your investments earn 6% per year, your account would be worth almost $680,000 by age 66. Wait until age 35, you will only accumulate $254,000. And what happens if you put off saving until age 45? In that case, you would ac cumulate just $120,000 by age 65. In this example, a 25-year delay cost you more than half a million dollars:

Of course, this example is hypothetical and for illustrative purposes only. It assumes a fixed 6% rate of return; however, no return can be guaranteed. This example does not take into account taxes or fees.

Finally, consider the type of account you choose to invest in and whether it is a tax-advantaged account or not. Tax advantaged accounts such as retirement accounts help you save tax-deferred over the long haul and may offer a tax deduction, as well. However, short-term goals like buying a house are more suitable for taxable accounts.

ASK THE EXPERTS

If you have the time and energy to educate yourself about investing, you may not feel you need assistance.

However, for many people—especially those with substantial assets and multiple investment accounts – it is worth getting expert help in creating a financial plan that integrates long-term financial goals such as retirement with other, more short-term needs.

REVIEW YOUR PROGRESS

Financial management is an ongoing process. Keep good records and recalculate your net worth annually.

This will help you for tax purposes, and show you how your investments are doing over time.

Once you take that first step of getting started, you will be better able to manage your money to pay for today’s needs and pursue tomorrow’s goals.

The views expressed are those of Azzad Asset Management. These views are subject to change at any time in response to changing circumstances in the markets and are not intended to predict or guarantee the future performance of any individual security or the markets generally, nor are they intended to predict the future performance of any Azzad account, strategy or fund.

Diversification, asset allocation and rebalancing cannot assure or guarantee better performance and cannot eliminate the risk of investment losses.

The information provided is for general information purposes only and should not be considered an individualized recommendation or advice. Azzad Asset Management makes no representations or warranties with respect to the accuracy or completeness of the information provided. Any illustrations are for hypothetical purposes only. Holdings are subject to change.

We strongly recommend you consult with your tax advisor for more information about your particular tax situation.