When are Islamic bonds not really Islamic? If you’re Sharjah-based energy company Dana Gas, the answer is: whenever the company says so. In June, the company announced that it no longer considered its two Islamic bonds, issued in 2013 and valued at $700 million, to be Shariah compliant under United Arab Emirates law. After Dana Gas made the claim that its debt is “unlawful and unenforceable,” a UAE court stopped bondholders from taking action against the company pending its review of the case.

Market observers see the move by Dana Gas as a shrewd move to avoid its current obligations and cut costs as it focuses on preserving cash following years of difficulty collecting on outstanding payments from clients in Egypt and the Kurdish region of Northern Iraq. Bloomberg reports that the company is owed about $1 billion from Egypt and Kurdistan and had about $298 million of cash on hand at the end of March.

Rather than inconveniencing equity owners in the company, executives appear to have instead opted to press its sukukholders to agree to a restructuring of terms that, according to Dana Gas, are more in keeping with the principles of Islamic finance but are also lower-yielding with longer maturity dates (read: more favorable to ownership).

Dana Gas plans to replace the current sukuk with four-year bonds paying “less than half of the current profit rates and without a conversion feature,” it said. The new profit payments will comprise a cash and payment-in-kind element, and the sukuk may be repaid either in whole, or in part at par, prior to its maturity without any penalty. A group of investors representing the sukukholders flatly refused the new offer, calling it “materially less favorable,” according to Bloomberg.

Test case for Islamic finance

What this means for the $2 trillion Islamic finance industry is unclear, but this development has gotten the attention of industry players. They wonder whether the tactic of deciding to declare one’s own Islamic assets as null and void creates additional unexpected risk in the industry as a whole. What’s to stop firms that use Islamic financial products, they ask, from “calling it quits” and renegotiating the terms of a deal that no longer seems like a good idea? Of course, this would be not unlike conventional borrowers who regularly use creative means to overcome unfavorable terms. The net effect in both cases could be higher borrowing costs.

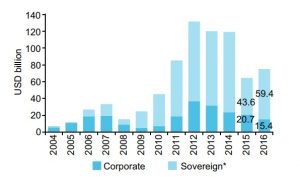

Global Sukuk Issuances – Sovereign and Corporate (2004-2016)

Source: Islamic Financial Standards Board, IFSI Stability Report 2017

It’s worth noting here that Dana Gas isn’t the first to claim Shariah incompliance. In 2009, Investment Dar of Kuwait argued its Islamic finance contract with Lebanon’s Blom Bank was not Shariah compliant. A court in the United Kingdom subsequently threw out the case.

As for Dana Gas, the company has said it will not pay the next two distributions due on July 31 and October 31 of this year as it presses the issue in the Sharjah Court of First Instance. A hearing is scheduled for December 25, despite the fact that the two sukuk in question reach maturity in October.

Lessons learned

Whatever the result of the Dana Gas court case may be, it’s clear that the sukuk industry is in need of global standards and a strongly regulated Shariah review board that ensures compliance. For international sukuk, the broader issue of enforceability and competing legal jurisdictions still stands out as an impediment to increased adoption of Islamic finance globally. As Azzad’s Ahsan Raheem, CFA®, has pointed out:

Global investors are looking for a more coherent understanding of contract enforceability from both legal and Shariah perspectives. There is a need for industry stakeholders, especially regulators and standard-setting institutions, to take more collaborative actions to standardize regulatory frameworks. This will provide the dual benefit of international confidence and strong legal backing to ensure investor protection.

(“International sukuk: a need for more disclosure and better transparency,” Thomson Reuters Zawya, Sukuk Perceptions and Forecast Study, 2014)

For many sukuk holders, including institutional investors like Azzad, the Dana Gas case is largely academic. They would typically avoid Islamic securities that are not sovereign or quasi-sovereign and would screen out distressed firms operating in conflict-prone regions like Kurdistan. Any candidate for investment would also need to be free of the balance sheet pressures that Dana Gas currently faces. That’s all part of the credit work the professionals do before entering into an investment.

The Dana Gas case is nevertheless instructive, if for no other reason than to illustrate the growing pains of a still-fledgling industry making its way in a world that demands accountability and transparency, two ideals prized by markets of all types–Islamic or not.

The following information is provided for informational purposes only and should not be considered investment advice or guidance, an offer of or a solicitation of an offer to buy or sell a security, or a recommendation or endorsement by Azzad of any security or investment strategy. Azzad does not guarantee that information supplied is accurate, complete or timely, and does not provide any warranties regarding results obtained from its use.

Not Islamic enough? Why a sukuk issuer now claims its ‘Islamic bond’ isn’t worthy of the name

Not Islamic enough? Why a sukuk issuer now claims its ‘Islamic bond’ isn’t worthy of the name

When are Islamic bonds not really Islamic? If you’re Sharjah-based energy company Dana Gas, the answer is: whenever the company says so. In June, the company announced that it no longer considered its two Islamic bonds, issued in 2013 and valued at $700 million, to be Shariah compliant under United Arab Emirates law. After Dana Gas made the claim that its debt is “unlawful and unenforceable,” a UAE court stopped bondholders from taking action against the company pending its review of the case.

Market observers see the move by Dana Gas as a shrewd move to avoid its current obligations and cut costs as it focuses on preserving cash following years of difficulty collecting on outstanding payments from clients in Egypt and the Kurdish region of Northern Iraq. Bloomberg reports that the company is owed about $1 billion from Egypt and Kurdistan and had about $298 million of cash on hand at the end of March.

Rather than inconveniencing equity owners in the company, executives appear to have instead opted to press its sukukholders to agree to a restructuring of terms that, according to Dana Gas, are more in keeping with the principles of Islamic finance but are also lower-yielding with longer maturity dates (read: more favorable to ownership).

Dana Gas plans to replace the current sukuk with four-year bonds paying “less than half of the current profit rates and without a conversion feature,” it said. The new profit payments will comprise a cash and payment-in-kind element, and the sukuk may be repaid either in whole, or in part at par, prior to its maturity without any penalty. A group of investors representing the sukukholders flatly refused the new offer, calling it “materially less favorable,” according to Bloomberg.

Test case for Islamic finance

What this means for the $2 trillion Islamic finance industry is unclear, but this development has gotten the attention of industry players. They wonder whether the tactic of deciding to declare one’s own Islamic assets as null and void creates additional unexpected risk in the industry as a whole. What’s to stop firms that use Islamic financial products, they ask, from “calling it quits” and renegotiating the terms of a deal that no longer seems like a good idea? Of course, this would be not unlike conventional borrowers who regularly use creative means to overcome unfavorable terms. The net effect in both cases could be higher borrowing costs.

Global Sukuk Issuances – Sovereign and Corporate (2004-2016)

Source: Islamic Financial Standards Board, IFSI Stability Report 2017

It’s worth noting here that Dana Gas isn’t the first to claim Shariah incompliance. In 2009, Investment Dar of Kuwait argued its Islamic finance contract with Lebanon’s Blom Bank was not Shariah compliant. A court in the United Kingdom subsequently threw out the case.

As for Dana Gas, the company has said it will not pay the next two distributions due on July 31 and October 31 of this year as it presses the issue in the Sharjah Court of First Instance. A hearing is scheduled for December 25, despite the fact that the two sukuk in question reach maturity in October.

Lessons learned

Whatever the result of the Dana Gas court case may be, it’s clear that the sukuk industry is in need of global standards and a strongly regulated Shariah review board that ensures compliance. For international sukuk, the broader issue of enforceability and competing legal jurisdictions still stands out as an impediment to increased adoption of Islamic finance globally. As Azzad’s Ahsan Raheem, CFA®, has pointed out:

(“International sukuk: a need for more disclosure and better transparency,” Thomson Reuters Zawya, Sukuk Perceptions and Forecast Study, 2014)

For many sukuk holders, including institutional investors like Azzad, the Dana Gas case is largely academic. They would typically avoid Islamic securities that are not sovereign or quasi-sovereign and would screen out distressed firms operating in conflict-prone regions like Kurdistan. Any candidate for investment would also need to be free of the balance sheet pressures that Dana Gas currently faces. That’s all part of the credit work the professionals do before entering into an investment.

The Dana Gas case is nevertheless instructive, if for no other reason than to illustrate the growing pains of a still-fledgling industry making its way in a world that demands accountability and transparency, two ideals prized by markets of all types–Islamic or not.

The following information is provided for informational purposes only and should not be considered investment advice or guidance, an offer of or a solicitation of an offer to buy or sell a security, or a recommendation or endorsement by Azzad of any security or investment strategy. Azzad does not guarantee that information supplied is accurate, complete or timely, and does not provide any warranties regarding results obtained from its use.

Recent Posts

Small Business Owners: What you need to know about CTA

4 Facts About Capital Gains

Top 3 Behavioral Mistakes Investors Make

Beware of your local banker

Weekly Market Recap – January 29, 2024

The Importance of Putting Barakah in Our Finances

Why consolidating your investments makes financial sense

Bumpy road ahead?

Market Timing Reminder: Just Say No

Why I became a financial advisor