The BOJ effect

Why sub-zero interest rates are good for Asian debt

Despite warnings that outflows following the 2013 “taper tantrum” would continue into this year, investor interest in emerging market (EM) debt — specifically Asian — has made a comeback.

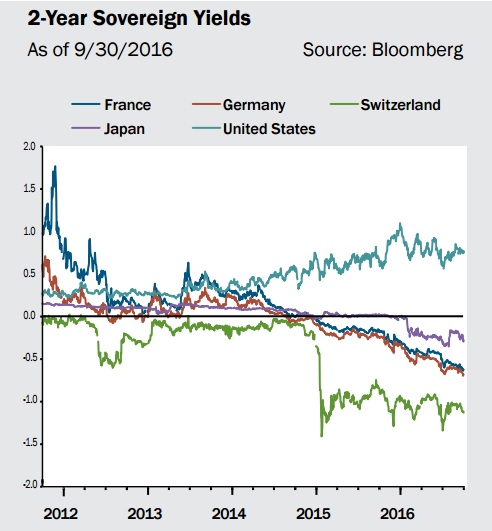

July’s asset inflows for EM debt funds, for example, stood at $13.3 billion globally, the highest monthly total for the category since Morningstar began collecting data. The asset class has benefited from several tailwinds since the start of the year, including a rebound in commodity prices and a restrained U.S. dollar. But central bank intervention, specifically negative interest rates in the developed world, stand out as the proximate cause for recent attention.

Asian credit markets in particular have benefited from easy money. The Bank of Japan, which adopted negative rates in early 2016, has taken extreme measures in an effort to counter deflationary trends in the country, including yield curve management.

The impact on Asia is most pronounced in Indonesian and Malaysian debt.

Take, for instance, sukuk from the region. These Islamic bonds have enjoyed outsized attention thanks to BOJ intervention. In addition to the low levels of sukuk issuance, negative rates have created what experts describe as a voracious search for yield. We can use a metric called “yield compression” to see if that’s really the case. Yield compression refers to the phenomenon in which money flowing into bonds causes prices to rise and yields to fall. The difference, or spread, between those yields compared to another often more stable investment is compressed when a force like negative interest rates compels investors to shop around for the best return. Compression in the yield spread can sometimes indicate that people are hungry for returns.

Let’s look at the yield/return on the US dollar-denominated Indonesia sovereign 2024 sukuk, which is rated Baa3 by Moody’s. It tightened from 4.2% to 3.4% over the last six months. Compare this to a similar Gulf sukuk issue, like the higher-rated Baa2 Emaar Malls Group 2024 sukuk, where yields/returns compressed from 4.1% to 3.7% over the same period. On a comparative basis, this compression example shows that investors are willing to venture further afield in Asia for moneymaking opportunities.

Is renewed interest in EM debt just a temporary trade resulting only from supportive monetary policy? Other factors suggest that longer-term prospects for EM debt aren’t just about yield.

With economic growth expected to rise, the International Monetary Fund has forecast that the growth differential between developed markets and emerging markets will increase in coming years. Debt-to-GDP ratios remain below those of developed markets. This coupled with policy reforms in Malaysia and Indonesia makes the long-term case for Asia, especially for higher-quality sovereign bonds.

The bottom line: expect interest in EM debt to remain attractive for income-seeking investors for the foreseeable future. Potential yields, supportive fundamentals, and global monetary policies are a powerful trio worthy of investor attention.

Joshua Brockwell is Investment Communications Director at Azzad Asset Management, a socially responsible registered investment advisor located in Falls Church, Virginia. Azzad is the sponsor of the Azzad Wise Capital Fund, a sukuk-oriented emerging market fixed income fund sub-advised by Federated Investment Management Company.

You should consider the Fund’s investment objectives, risks, charges and expenses before investing. A prospectus with this and other information about the Fund is available online at www.azzadfunds.com/prospectus or by calling 888-86-AZZAD. Please read the prospectus carefully before investing. Azzad Asset Management is the investment advisor to the Azzad Funds. The Funds are self-distributed.

The opinions and views expressed herein are current as of the date indicated, are subject to change without notice, and do not take into account particular investment objectives, financial situation or the needs of individual investors. They are not intended to be relied upon as a prediction or forecast of actual future events or performance, guarantee of future results, recommendations or advice. Statements made in this material are not intended as buy or sell recommendations of any securities. Forward-looking statements are subject to uncertainties that could cause actual developments and results to differ materially from the expectations expressed. This information has been prepared from sources believed reliable, but the accuracy and completeness of the information cannot be guaranteed.