This has been the worst ever start to a year for the stock market, and stocks tanked again today. But that’s not all. Investors are seeking the security of government bonds. Oil continues to trade below $30 a barrel. Netflix is raising its prices. A massive snowstorm threatens the Mid-Atlantic. The new Star Wars movie didn’t get an Oscar nomination for best picture. The list of panic and chaos could go on.

These recent events (at least the ones related to financial markets) have triggered lots of angst and questions from investors, some of which we responded to last Friday.

Our readers have done most of the asking lately, but now it’s our turn to pose a couple of questions to you:

1) Do you have a strategy?

How do you deal with market drops like the one we saw today? Instead of repeatedly smashing your head into the laptop, consider a more constructive approach. Rebalancing your portfolio so that your original asset allocation (mix of stocks, fixed income, and cash) is where you intended it to be could be a good move.

To bring your asset allocation back to the original percentages you set for each type of investment, you’ll need to do something that may feel counterintuitive: sell some of what’s working well and use that money to buy investments in other sectors that now represent less of your portfolio. Typically, you’d buy enough to bring your percentages back into alignment. This keeps what’s called a “constant weighting” of the relative types of investments.

Since stocks have dropped and may now represent less of your portfolio than they should, to rebalance you would invest in stocks until they once again reach an appropriate percentage of your portfolio.

Let’s look at a hypothetical illustration: If stocks have fallen, a portfolio that originally included 70% in stocks and 30% in fixed income might now have only 60% in stocks and 40% in fixed income. Rebalancing would involve selling some of your fixed income investments and using the proceeds to buy enough stock to bring the percentage of stock in the portfolio back to the original 70%.

Ask your Azzad advisor for more information about rebalancing.

2) Have you looked on the bright side?

Like every cloud, a down market has a silver lining. The silver lining of a down market is the opportunity to buy shares of stock at lower prices.

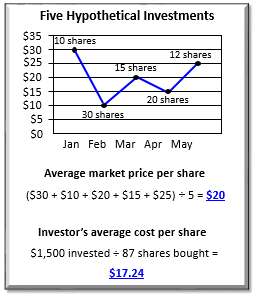

One of the ways you can do this is by using dollar-cost averaging. With dollar-cost averaging, you don’t try to “time the market” by buying shares at the moment when the price is lowest. In fact, you don’t worry about price at all. Instead, you invest a specific amount of money at regular intervals over time. When the price is higher, your investment dollars buy fewer shares of an investment, but when the price is lower, the same dollar amount will buy you more shares. A workplace savings plan, such as a 401(k) plan in which the same amount is deducted from each paycheck and invested through the plan, is one of the most well-known examples of dollar cost averaging in action.

For example, let’s say that you decided to invest $300 each month. As this hypothetical illustration shows, your regular monthly investment of $300 bought more shares when the price was low and fewer shares when the price was high:

Source: Forefield Communications.

For illustrative purposes only.

Actual results may vary.

See how it works? In this example, your average cost per share is lower than the average market price.

Although dollar-cost averaging can’t guarantee you a profit or avoid a loss, a regular fixed dollar investment may result in a lower average price per share over time, assuming you continue to invest through all types of market conditions.

Whatever your strategy, you’ve got to be willing to endure market conditions of all stripes. Investing isn’t for the faint of heart. Take the bad with the good. And like that Star Wars movie that didn’t get an Oscar nod, things might just turn out OK in the end.

Past performance cannot guarantee future results. No investment strategy can eliminate the risk of losses. Asset allocation, dollar cost averaging, rebalancing, and diversification are investment strategies used to help manage risk. They do not ensure a profit or protect against a loss.