Democratic contender Joe Biden maintains a lead against President Donald Trump in opinion polls.

Granted, plenty can change in the days leading up to next month’s vote, but how might your portfolio perform if the polls are right and Biden wins on November 3rd?

A Biden victory would undercut the lower-tax, lower-regulation era installed by President Trump and the Republican party. Under Biden, the corporate tax rate is likely to increase to 28%, reversing half of the cut enacted in late 2017 and hurting corporate earnings, a major driver of stock prices.

Of course, plenty of investors remain unconvinced that the November election will have any long-term bearing on the direction of the stock market, especially as the Federal Reserve is expected to backstop the U.S. economy if needed. For many market observers, the person most capable of influencing stocks for better or worse is not the president; it’s the head of the Federal Reserve, Jerome Powell.

So, which party is better for investors–Democrats or Republicans?

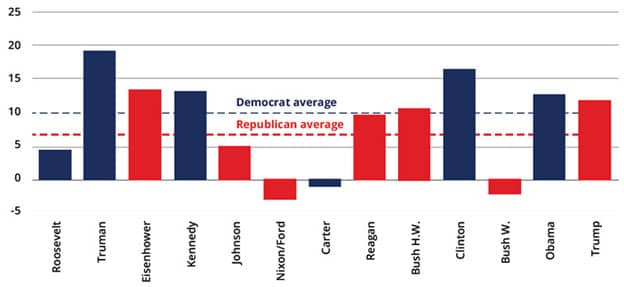

Since 1933, Democratic presidents have, on average, seen higher stock market returns than Republican ones. For example, the average real (adjusted for inflation) total return for the S&P 500 Index under Democratic presidents was 10.2%, versus 6.9% under Republicans.

Democratic Presidents Saw Higher Stock Market Returns Compared to Republican Presidents S&P 500 Index annual real total return, %

The problem is that nearly all of this average outperformance advantage can be explained by the boom years under Bill Clinton and the subsequent dotcom bust and Global Financial Crisis under George W. Bush. Excluding these two presidencies, the difference in returns is practically zero.

Neither political party is exclusively good or bad for markets. Instead, what matters more is the policies presidents choose to enact and their net impact. For example, although President Trump’s tax cuts were widely seen as a positive development for markets, his handling of foreign policy and trade issues had the opposite effect.

A potential Biden administration could be a boon for some sectors (e.g., health care) and a bust for others (e.g., energy).

Bottom line: Whether it’s Biden or Trump, nobody can predict what will happen in future administrations. Investors would be wise to position their portfolios to meet their financial goals, not in anticipation of a presidential election.