Probably not, but caution is still warranted.

In your role as a retirement Plan Sponsor – or plan participant for that matter – it’s likely you benefited from the sharp rally stocks experienced since March. You know probably stand distinctly in one of two camps:

A. You feel confident stocks will continue to perform well, and you may even be somewhat complacent given the gut-wrenching volatility we felt earlier this year is now a fading memory.

B. You are nervous about investments, the economy, and a lot more, and feel compelled to liquidate a portion of your stock holdings (if you haven’t already).

Which approach is correct, and which will benefit investors the most going forward? We suggest that some combination – essentially a dose of both optimism and concern – provides investors the best potential for positive long-term results.

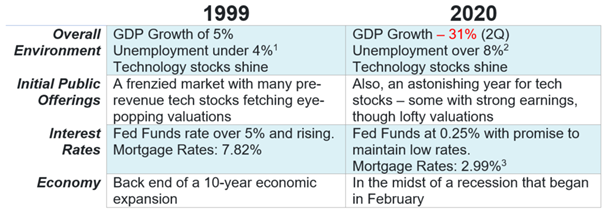

A comparison to 1999 – a setting which preceded agonizing stock market losses and an economic downturn – to our current environment is a good starting point.

On the one hand, it is perfectly logical that today’s uncertain times would cause concern or even fear among investors. On the other, it is quite encouraging to have an accommodating Fed, historically low interest rates and signs of recovery in manufacturing. The numbers and forecasts are so disparate that it feels like one could grab hold of some statistic to support just about any economic or financial position–whether you’re a bull or a bear.

What should investors do?

Given the uncertainty in the markets and economy, when a coronavirus vaccine will be distributed and the ultimate impact of the elections, we recommend against impulsive decisions or making large bets on macro events in your portfolio. Instead, we favor investors adopt this three-step approach:

1. Be as clinical as possible: The volume of news, data points, op-eds, etc. can be overwhelming and have very little to do with your unique circumstances or how your portfolio should be constructed. We strongly encourage clients to work with their Azzad advisor to examine their inflows, outflows, and required return. This produces overarching guidance in building portfolios, allocating assets and selecting (or replacing) specific investments.

2. Diversify: Gamblers place big bets. Reasoned investors attempt to attain their goals (required returns) while mitigating risk. No one knows when this pandemic will end. Similarly, assuming large U.S. stocks will dominate indefinitely is ill-informed.

3. Thoughtfully rebalance: As we’ve seen volatility pick up, portfolios may gyrate from intended target allocations. It is especially important – particularly if we again see wild fluctuations in stocks as we did last spring – to not only stick to your well-conceived plan but to rebalance in a measured manner.

It is doubtful that your portfolio is as vulnerable as it was back in 1999. However, with so much uncertainty on so many fronts, one could contend that it has never been more important to own a broadly, thoughtfully diversified portfolio.