Enhanced Child Tax Credit for 2021

If you have qualifying children under the age of 18, you may be able to claim a child tax credit. (You may also be able

If you have qualifying children under the age of 18, you may be able to claim a child tax credit. (You may also be able

After languishing for several months in bureaucratic limbo, the SECURE Act (Setting Every Community Up for Retirement Enhancement) was signed into law on December 20,

It’s hard to believe we’re fast approaching the end of 2019, but it’s true. Here are four things to consider as you weigh potential tax

If you’re in the market for a vacation home, an LLC could be a smart way to own that property. An LLC, or limited liability

Paying taxes is part of the responsibility of living in the United States. But most people understandably don’t want to pay more than they have

Selecting a filing status is one of the first decisions you’ll make when you fill out your federal income tax return, so it’s important to

Self-employment is the opportunity to be your own boss, to come and go as you please, and oh yes, to establish a lifelong bond with

U.S. tax law has changed since you filed your federal taxes for 2017; the Tax Cuts and Jobs Act takes effect for 2018 tax filings.

The end of the year is full of deadlines for your financial matters. Here are three of the most important to-do items when it comes

The end of the year will be here before you know it. Consider making the following IRA tips into New Year’s resolutions and start 2019

The U.S. stock market this year has given total returns so far of close to 10 percent, which is a good thing for investors. But with

Estate planning isn’t the most exciting thing to do, but it’s one of the most important–both for yourself and your family. If you have minor

According to the most recent Congressional Budget Office (CBO) projection, the federal budget deficit for fiscal year 2018 (which ends on September 30) will reach

We talk with a lot of people who come to us seeking advice about using annuities. We get why annuities can be attractive: they’re usually

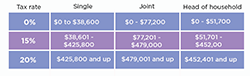

Did you know that you or your heirs might be eligible for a 0% rate on long-term capital gains and dividends? The Tax Cuts and

You can be forgiven if you didn’t read all of the 600-page tax bill that Congress passed last year. Most members of Congress probably didn’t

Here are 10 things to consider as you weigh potential tax moves between now and the end of the year. 1. Set aside time to

Nothing lasts forever, not even the tax deferral on your IRA. When you turn 70½, the government will require that you withdraw money from your

At this time of year many Americans are thinking about taxes. Even if you’ve already filed your 2016 returns, it’s a good idea to start

Do you know how much you’re allowed to contribute to your IRA each year? Are you periodically tracking your deposits? Contributing more than the permitted

Halal investments for retirement, education, and all your savings goals

The services and products described on this website are intended to be made available only to U.S. persons. This website does not constitute an offer or solicitation by Azzad of securities or services to any person residing outside the United States or in any jurisdiction in which such an offer or solicitation would be unlawful under the applicable laws. Before becoming a client, please read our firm’s Part 2A of form ADV (“Part 2”), Appendix 1 of the Firm Brochure (“Wrap Brochure”), your representative’s Part 2B if applicable, and our Part 3 CRS Form. If you are an ERISA client, you should also read our Section 408(b)(2) disclosure. These and other important disclosures can be mailed to you by calling 888.862.9923.

Please consider a fund’s objectives, risks, charges and expenses carefully before you invest. The prospectus contains this and other important information. For a hard copy, please call 1-888-350-3369. Please read the prospectus carefully before investing or sending money. Nothing on this website should be considered a solicitation to buy, an offer to sell, or a recommendation for any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful. The Azzad Funds are self-distributed; Azzad Asset Management serves as the investment adviser.

3141 Fairview Park Drive, Suite 355, Falls Church, VA, 22042 | 888-862-9923

You are about to leave the Azzad website and enter a third-party website. We are not responsible for and cannot guarantee the accuracy of any information on a third-party website.

Click the link above to continue or CANCEL