Top Year-End Investing Tips

Just what you need, right? One more time-consuming task to be taken care of between now and the end of the year. But taking a

Just what you need, right? One more time-consuming task to be taken care of between now and the end of the year. But taking a

After languishing for several months in bureaucratic limbo, the SECURE Act (Setting Every Community Up for Retirement Enhancement) was signed into law on December 20,

It’s hard to believe we’re fast approaching the end of 2019, but it’s true. Here are four things to consider as you weigh potential tax

Even if you are nearing retirement and have a large 401(k) or IRA balance, you may not have as much money as you think. Lots

The once-per-year limit on IRA-to-IRA rollovers is a terrible trap for unwary taxpayers. It’s easy to fall into, but also easy to avoid. Here is

People don’t often think of the IRS as their friend. But there is at least one taxpayer-friendly thing the IRS is known for: its process

You’re probably familiar with traditional 401(k) plans, and we hope you know about Roth IRAs as well. (If not, check out these 5 things you

The end of the year is full of deadlines for your financial matters. Here are three of the most important to-do items when it comes

The end of the year will be here before you know it. Consider making the following IRA tips into New Year’s resolutions and start 2019

With the lure of tax-free distributions, Roth IRAs have become popular retirement savings vehicles. According to the 2017 Investment Company Fact Book, about 17.4% of

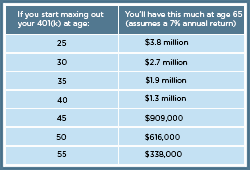

Only 13% of retirement savers maxed out their 401(k) contributions last year. Were you one of them? One great thing about saving for retirement in

By Ehab Alalfey Azzad Investment Advisor Fresh off a trip to an IRA conference organized by consumer advocate and IRA expert Ed Slott, Azzad’s Ehab

Which should you use for your financial goals? Mutual funds have been long been the choice for investors seeking professional money management. When you buy

When money gets tight, you might start thinking about raiding your retirement nest egg. Before you do, we urge you to consider how much it

Azzad has been working with Charles Schwab to make the portfolios in the Azzad Ethical Wrap Program available in its retirement plans. If your employer

Do you have a 401(k)? Ever wondered if you could roll over that account into a Roth IRA? You might be surprised to hear that

Do you know how much you’re allowed to contribute to your IRA each year? Are you periodically tracking your deposits? Contributing more than the permitted

The IRS allows you to correct most errors. However, there is one error you cannot fix that could seriously harm your retirement funds. It’s a

Not long ago, the North American Securities Administrators Association (NASAA) issued a warning to investors about custodians who handle self-directed individual retirement accounts (IRAs). A

On April 6, 2016, the Department of Labor (DOL) issued new “conflict of interest” rules regarding financial advice as it relates to retirement plans and

Halal investments for retirement, education, and all your savings goals

The services and products described on this website are intended to be made available only to U.S. persons. This website does not constitute an offer or solicitation by Azzad of securities or services to any person residing outside the United States or in any jurisdiction in which such an offer or solicitation would be unlawful under the applicable laws. Before becoming a client, please read our firm’s Part 2A of form ADV (“Part 2”), Appendix 1 of the Firm Brochure (“Wrap Brochure”), your representative’s Part 2B if applicable, and our Part 3 CRS Form. If you are an ERISA client, you should also read our Section 408(b)(2) disclosure. These and other important disclosures can be mailed to you by calling 888.862.9923.

Please consider a fund’s objectives, risks, charges and expenses carefully before you invest. The prospectus contains this and other important information. For a hard copy, please call 1-888-350-3369. Please read the prospectus carefully before investing or sending money. Nothing on this website should be considered a solicitation to buy, an offer to sell, or a recommendation for any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful. The Azzad Funds are self-distributed; Azzad Asset Management serves as the investment adviser.

3141 Fairview Park Drive, Suite 355, Falls Church, VA, 22042 | 888-862-9923

You are about to leave the Azzad website and enter a third-party website. We are not responsible for and cannot guarantee the accuracy of any information on a third-party website.

Click the link above to continue or CANCEL