Fab five stocks are driving this market

Did you know that the five largest stocks in the S&P 500 now account for 22 percent of the index’s market capitalization? That’s the latest

Did you know that the five largest stocks in the S&P 500 now account for 22 percent of the index’s market capitalization? That’s the latest

In April, the Dow Jones Industrial Average staged its best two-week performance since the 1930s, a dramatic rebound that illustrates a bizarre reality about the

In order to help clients navigate the extreme market volatility related to the coronavirus pandemic, we’ve put together the list of FAQs below. Check back

Recent news about the coronavirus outbreak is tragic, with unimaginable and unmeasurable implications for the many affected. As we attempt to discern incoming economic data,

Last month, Azzad Ethical Fund portfolio manager Christian Greiner, CFA®, presented Azzad’s 2020 Investment Outlook webinar. The full recording can be watched here, but here’s

Last week, global markets added the word “coronavirus” to their collective vocabulary. And with that, the calm that had settled over financial markets in recent

As we reach the end of autumn, let’s look back on a momentous event that occurred 70 years ago this fall — the 1929 stock

We often talk about market volatility in the midst of surprise drops, but it’s useful to consider during calmer moments what behavior could be best

Fifty-five percent of the super-rich around the world are already preparing for a recession. That’s according to a survey by Swiss wealth management company UBS

President Donald Trump warned in a tweet last month amid the Ukraine whistleblower inquiry that his impeachment would cause “the markets crash.” Trump’s tweet came

Stocks were under pressure for much of August as U.S.-China trade tensions escalated, with Washington and Beijing announcing escalating rounds of tariff increases. Worries over

For the time being, uncertainty will probably hang around like a dark cloud over markets. But that doesn’t mean you should head for the hills.

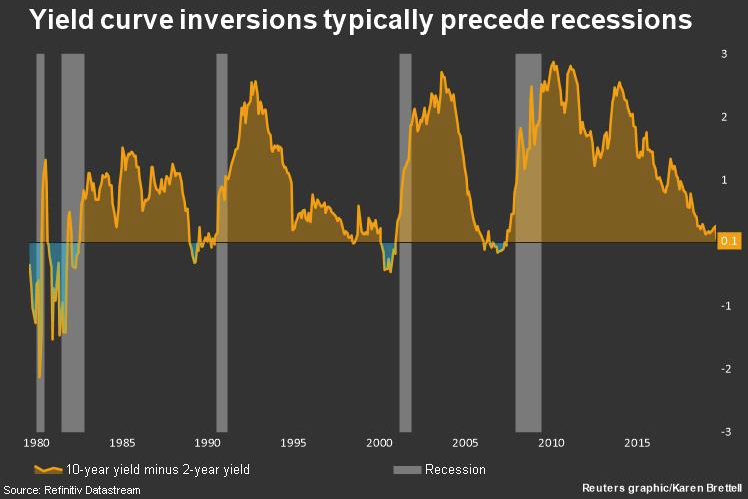

It’s only natural to talk about what might be ahead for markets and the economy. We’re currently living through one of the longest economic expansions

We’ve been talking a lot around the office lately about the next recession and how to prepare our clients for that eventuality. It’s part of

Financial markets showed signs of stabilizing on Tuesday, a day after China’s announcement of retaliatory tariffs on 5,140 imports from the United States touched off

In mid-December, the Federal Reserve raised interest rates again, contributing to some of the whipsaw volatility we saw at the end of the year. As

Recent market volatility is a reminder that there are risks to investing. Given that markets has risen over the past 10 years without a major

Short answer: Who cares? You’re not selling today, so don’t fret. Longer answer: The last time was eight months ago, but let’s put things in

Is it time for stocks to sell off? In light of the 10th anniversary of the collapse of Lehman Brothers last month, we should remember

Joshua Brockwell is Investment Communications Director at Azzad Asset Management. He can be reached at joshua@azzadfunds.com A selloff in Turkish markets over the last few

Halal investments for retirement, education, and all your savings goals

The services and products described on this website are intended to be made available only to U.S. persons. This website does not constitute an offer or solicitation by Azzad of securities or services to any person residing outside the United States or in any jurisdiction in which such an offer or solicitation would be unlawful under the applicable laws. Before becoming a client, please read our firm’s Part 2A of form ADV (“Part 2”), Appendix 1 of the Firm Brochure (“Wrap Brochure”), your representative’s Part 2B if applicable, and our Part 3 CRS Form. If you are an ERISA client, you should also read our Section 408(b)(2) disclosure. These and other important disclosures can be mailed to you by calling 888.862.9923.

Please consider a fund’s objectives, risks, charges and expenses carefully before you invest. The prospectus contains this and other important information. For a hard copy, please call 1-888-350-3369. Please read the prospectus carefully before investing or sending money. Nothing on this website should be considered a solicitation to buy, an offer to sell, or a recommendation for any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful. The Azzad Funds are self-distributed; Azzad Asset Management serves as the investment adviser.

3141 Fairview Park Drive, Suite 355, Falls Church, VA, 22042 | 888-862-9923

You are about to leave the Azzad website and enter a third-party website. We are not responsible for and cannot guarantee the accuracy of any information on a third-party website.

Click the link above to continue or CANCEL