Year-end investment tips

Just what you need, right? One more time-consuming task to be taken care of between now and the end of the year. But taking a

Just what you need, right? One more time-consuming task to be taken care of between now and the end of the year. But taking a

Is it time for stocks to sell off? In light of the 10th anniversary of the collapse of Lehman Brothers last month, we should remember

The U.S. stock market this year has given total returns so far of close to 10 percent, which is a good thing for investors. But with

Are you concerned about the risks associated with keeping all your money in one place? We hope this will help put you at ease. Don’t

We talk with a lot of people who come to us seeking advice about using annuities. We get why annuities can be attractive: they’re usually

In the past three months, we’ve seen bond markets struggle against a backdrop of rising rates and geopolitical tensions. Here’s how Azzad’s fixed-income portfolio manager,

Are you a DIY investor? Do-it-yourself (DIY) investors are always on the lookout for stock tips and asking their financial advisor to make lots of

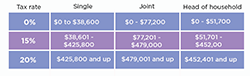

Did you know that you or your heirs might be eligible for a 0% rate on long-term capital gains and dividends? The Tax Cuts and

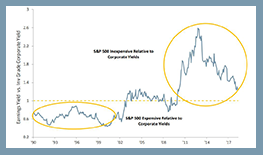

Recent U.S. equity market weakness and volatility likely has some investors wondering if they should cut their exposure to stocks in favor of fixed income/bonds.

Omaha, Nebraska is famous for being the home of one of the world’s most renowned investors, Warren Buffett. Indeed, the Oracle of Omaha, as he’s

Passive management, or buying stocks that track an index, has caught on over the last several years. But changes in the economy and markets have

Although the stocks of large companies like Amazon and Alphabet have been among the market leaders since last year, in recent months they’ve started to

Which should you use for your financial goals? Mutual funds have been long been the choice for investors seeking professional money management. When you buy

President Trump announced on October 16 that the Affordable Care Act, commonly known as Obamacare, is “dead.” How should investors interpret this new level of

1) What are required minimum distributions (RMDs)? Required minimum distributions, often referred to as RMDs, are amounts that the government requires you to withdraw annually

Different types of investments perform better in different market conditions. Investing in a variety of assets like stocks, fixed income, and real estate can result

Staying focused on the bright side is admittedly hard to do when the markets are volatile. Fortunately, there are always some silver linings amid market

Investors who pay attention only to a fund’s return are missing out on valuable information. Determining how a fund achieved its returns can be just

When evaluating investment performance, investors should consider both return and risk. Unfortunately, many investors stress the importance of the former and neglect the latter. This is

It’s official. The bird began trading on Wall Street last week with its IPO surging over 70% bringing the company’s value to more than $25

Halal investments for retirement, education, and all your savings goals

The services and products described on this website are intended to be made available only to U.S. persons. This website does not constitute an offer or solicitation by Azzad of securities or services to any person residing outside the United States or in any jurisdiction in which such an offer or solicitation would be unlawful under the applicable laws. Before becoming a client, please read our firm’s Part 2A of form ADV (“Part 2”), Appendix 1 of the Firm Brochure (“Wrap Brochure”), your representative’s Part 2B if applicable, and our Part 3 CRS Form. If you are an ERISA client, you should also read our Section 408(b)(2) disclosure. These and other important disclosures can be mailed to you by calling 888.862.9923.

Please consider a fund’s objectives, risks, charges and expenses carefully before you invest. The prospectus contains this and other important information. For a hard copy, please call 1-888-350-3369. Please read the prospectus carefully before investing or sending money. Nothing on this website should be considered a solicitation to buy, an offer to sell, or a recommendation for any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful. The Azzad Funds are self-distributed; Azzad Asset Management serves as the investment adviser.

3141 Fairview Park Drive, Suite 355, Falls Church, VA, 22042 | 888-862-9923

You are about to leave the Azzad website and enter a third-party website. We are not responsible for and cannot guarantee the accuracy of any information on a third-party website.

Click the link above to continue or CANCEL