How to Boost your Retirement Savings

For many of us, a trip to the grocery store is a constant reminder of how much inflation keeps creeping into our pocketbooks. Add taxes,

For many of us, a trip to the grocery store is a constant reminder of how much inflation keeps creeping into our pocketbooks. Add taxes,

One of the first decisions you’ll need to make after accepting a job offer is deciding how you’ll invest your employer plan. These plans are

What are RMDs? At some point, the government wants you to start spending your tax-sheltered retirement savings, or at least pay taxes on the income.

When was the last time you reviewed your beneficiary designations? The beneficiaries you name on your financial accounts take precedence over a trust or will.

The beginning of a new year is a great time to commit toward improving your financial life. Do you have an old 401(k) that’s riddled

What do a supermodel, Shark Tank star and sovereign wealth fund have in common? They all failed to ask questions before investing their money. The

Here is an update on some significant changes designed to help Americans save more for retirement. You may have heard of the SECURE Act 2.0,

Who among us wants to pay the IRS more taxes than we have to? While few may raise their hands, Americans regularly overpay because they

When our parents retired, living to 75 amounted to a nice long life, and Social Security was often supplemented by a pension. The Social Security

Every year, the College Board releases new college cost data and trends in its annual report. The figures published are average cost figures based on

Did you recently add a second comma to your bank balance? Has a recent financial event raised your net worth to the next level? It’s

The end of the year is nearly here, which means the season of giving is upon us. Have you determined your charitable giving strategy for

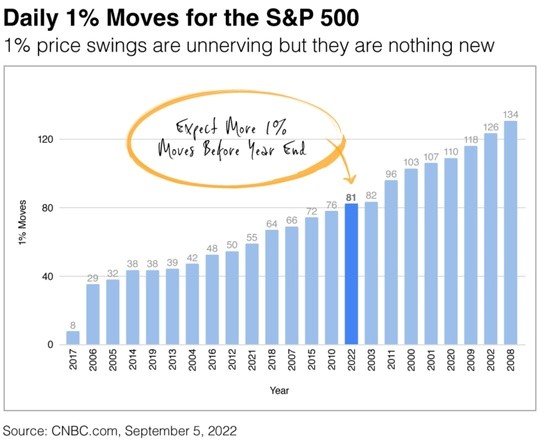

If you’ve felt like stock prices have been more volatile in 2022 than in recent years, you’re right on the money. Let’s take a look.

When the rules of the game change, your tactics should follow in response to the new landscape. While estate tax exemptions have ridden an uncertain

On August 24, 2022, just a few days before federal student loan repayment was set to resume, President Biden announced a plan for additional student

One silver lining in the currently challenging environment for stocks is that this could be a good time to convert assets from a traditional IRA

“Almost any decision is better than no decision at all.” – Brian Tracy Whether through inertia or trepidation, investors who put off important investment decisions

Conventional wisdom says that what goes up must come down. But even if you view market volatility as a normal occurrence, it can be tough

The year 2022 has already heaped loads of uncertainty onto investors and companies, from the invasion of Ukraine to pandemic-driven supply chain disruptions. To top

Legendary investor Warren Buffett is famous for his long-term perspective. He has said that he likes to make investments he would be comfortable holding even

Halal investments for retirement, education, and all your savings goals

The services and products described on this website are intended to be made available only to U.S. persons. This website does not constitute an offer or solicitation by Azzad of securities or services to any person residing outside the United States or in any jurisdiction in which such an offer or solicitation would be unlawful under the applicable laws. Before becoming a client, please read our firm’s Part 2A of form ADV (“Part 2”), Appendix 1 of the Firm Brochure (“Wrap Brochure”), your representative’s Part 2B if applicable, and our Part 3 CRS Form. If you are an ERISA client, you should also read our Section 408(b)(2) disclosure. These and other important disclosures can be mailed to you by calling 888.862.9923.

Please consider a fund’s objectives, risks, charges and expenses carefully before you invest. The prospectus contains this and other important information. For a hard copy, please call 1-888-350-3369. Please read the prospectus carefully before investing or sending money. Nothing on this website should be considered a solicitation to buy, an offer to sell, or a recommendation for any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful. The Azzad Funds are self-distributed; Azzad Asset Management serves as the investment adviser.

3141 Fairview Park Drive, Suite 355, Falls Church, VA, 22042 | 888-862-9923

You are about to leave the Azzad website and enter a third-party website. We are not responsible for and cannot guarantee the accuracy of any information on a third-party website.

Click the link above to continue or CANCEL