Inflation worries have become headline news after prices rose 4.2% in April from a year earlier, the highest jump since 2008[1]. Many wonder if this is just a temporary spike driven by a recharged economy after a historic pandemic or if it’s part of a worrisome trend that may affect their investment plans. When you break it down, the data isn’t that scary. This FAQ document will answer some of the most common questions we’ve received from clients lately.

What is inflation and how is it measured?

Inflation is defined as the change in the price of everything from groceries, clothing and housing to automobiles, utilities and even health care services. It refers to the broad-based and sustained increase in prices year-over-year. It occurs when demand exceeds supply. Moderate inflation is a sign of a healthy economy. It encourages you to spend or invest your money, rather than hiding it under your mattress as it loses value.

There are many ways to measure inflation, but the most widely used (and quoted by the media) is the Consumer Price Index (CPI). The CPI is the average price of a basket of goods and services that households typically purchase. The Federal Reserve prefers a different inflation measure called the Personal Consumption Expenditures, or PCE. The PCE captures changes in consumer behavior and has a broader scope than the CPI. More specifically, the Fed prefers core PCE which excludes volatile food and energy prices.

Regardless of which index you use to measure inflation, prices are higher than a year ago. Core PCE (although lower than CPI) rose a faster-than-expected 3.1% in April[2]. The Fed considers 2% appropriate for healthy economic growth.

What is driving the rising prices?

If we look closer at what is behind the higher CPI, the data suggests it wasn’t a broad-based rise across all goods and services. In fact, only three categories were responsible for pushing the inflation rate above recent averages. Used cars and trucks, energy, and transportation services experienced price increases of 21 percent, 47.9 percent, and 5.6 percent, respectively[3]. All the other major expenditures were in line with long-term averages.

In addition to rising prices, one of the main reasons for the rise is due to base effects which essentially creates an arithmetic anomaly. As Covid shut down the U.S. economy, prices reached an unusual bottom. Since current prices are compared against last year’s unusual base, the year-to-year data will be distorted for at least a few more months.

As life returns to normal, you should expect prices to be comparatively higher. Nowhere is this more visible than with the price of energy. After collapsing to depressed levels last year, the price of Brent crude oil traded at pre-Covid levels last month at $64.81 a barrel (compared with $18.38 a barrel in April 2020)[4]. All things being equal, later months of year-over-year comparisons shouldn’t have such big distorting effects.

Could inflation get hotter over the next three to five years?

For the reasons cited above, most economists (and the Fed) view the current rise as temporary. That is not to say that inflation couldn’t begin to rise in the coming years. One-time stimulus checks just aren’t significant enough to drive inflation. However, if labor costs were to rise substantially, and the current supply chain disruptions persisted, we could see excess demand for supplies lead to inflation. The Biden administration, Congress and the Federal Reserve could also influence inflation with some of their policies.

Of course, the expectation of inflation also matters because such expectations can affect how businesses, policymakers and consumers behave. For example, if businesses believe inflation is on its way, they might proactively increase prices, and that can raise inflation. The bottom line: you should consider inflation when constructing your financial plan. But don’t get spooked, stay calm.

Expect higher prices for some items as the economy reopens. No one likes higher prices, but, again, it’s important to keep these increases in perspective. Gasoline, jet fuel, and other petroleum prices are rising after being deeply depressed during the pandemic. Airline ticket prices are increasing but remain below their pre-pandemic levels. Used cars and trucks are more expensive than before the pandemic, but clothing is still cheaper. Food is up 3.5% over the last 12 months, a significant increase but not extreme for prices that tend to be volatile.

For now, it may be helpful to remember that headline inflation does not always represent the larger economy. And with interest rates near zero, the Federal Reserve has plenty of room to make any necessary adjustments to monetary policy.

What does inflation mean for your investments?

Remember your goal as an investor is to grow your money at a rate that will meet your goals and exceed inflation. With nothing to mitigate its effects, cash suffers the most from inflation. Short-term bonds, including a majority of the Shariah-compliant securities held by the Azzad Wise Capital Fund (WISEX), are preferable in this kind of environment.

Although inflation can be challenging to stocks, stocks have nonetheless performed well over the long run, especially when dividends are reinvested, and you take advantage of compounding over time. Of course, to receive these higher returns, you must be willing to accept risk.

Consider that the average annual return on stocks (as measured by the S&P 500) was about 11% between 1970 and May 27, 2021. Overall, inflation averaged 7.1% during the seventies. Since 1995, inflation has been virtually nonexistent.

Source: Morningstar Annualized return for S&P 500 TR USD January 30, 1970-May 27, 2021.

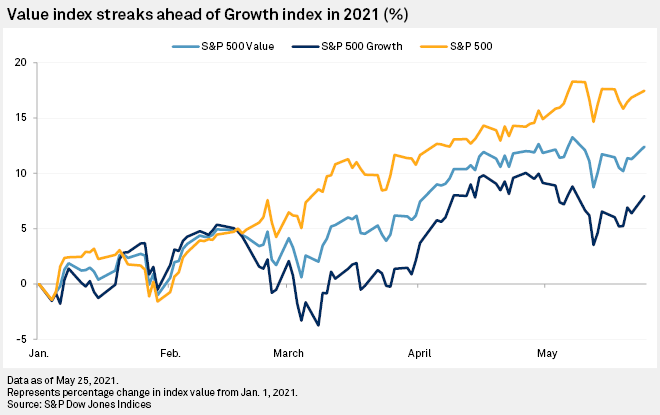

Regardless of what happens, a diversified portfolio (with value exposure) will be critical. Growth stocks (think Big Tech) tend to underperform as inflation increases because of how future cash flows are calculated. Much of their earnings expectations are in the future, and when rates rise, it hurts those expectations. With already high valuations, such stocks are priced for near perfection. In other words, such high growth stocks have a high hurdle to jump. On the other hand, for companies classified as value stocks, each year they make about the same amount of profit, so inflation doesn’t hurt as much.

In fact, after outperforming during the pandemic, tech-heavy growth stocks have already started to underperform high-quality value stocks this year.

Now, more than ever, investors will need a portfolio management team with a valuation discipline incorporated across their investment philosophy and processes. We invite you to take a closer look at our Shariah-compliant investment portfolios and diverse portfolio management team. We also recommend that you reach out to your Azzad advisor to review your portfolio’s current asset allocation.

This content is for informational and educational purposes only and not intended as investment advice or a recommendation to buy or sell any security. Investment advice and recommendations can be provided only after careful consideration of an investor’s objections, guidelines and restrictions. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Projections are based on current conditions, are subject to change, and may not come to pass.

[1] U.S. Bureau of Labor Statistics

[2] Bureau of Economic Analysis

[3] https://blog.commonwealth.com/independent-market-observer/is-inflation-as-scary-as-it-seems

[4] Statista