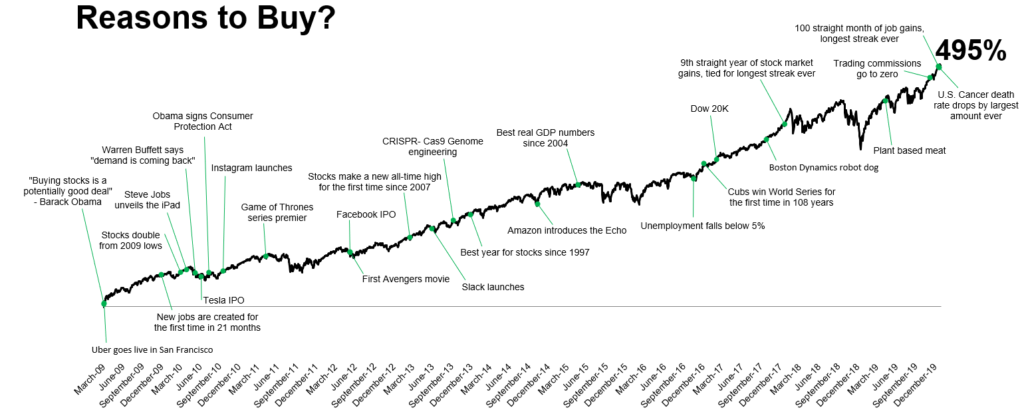

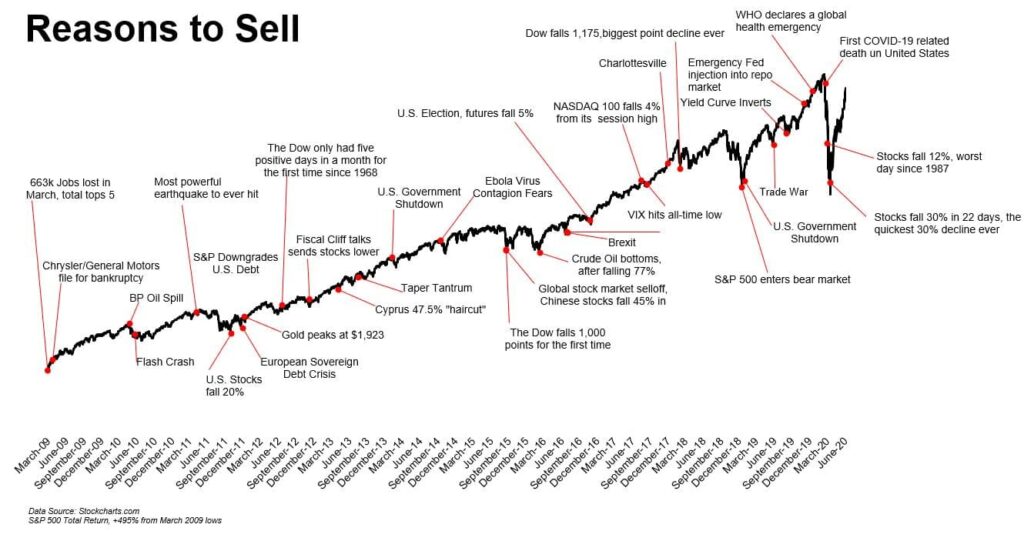

Investors can always find a reason to sell. But long term, the market rewards those who stay patient.

Third quarter market recap

What happened: Every quarter this year has brought major events for investors to digest. The third quarter was no different. From a United States’ credit rating downgrade to higher energy prices, investors had a lot to digest. Ultimately, however, most asset classes did end the quarter lower. Rising interest rates were a main driver of the lackluster results across asset classes.

Yes, but: Despite the market struggling thus far in the back half of the year, the broader economic backdrop remains resilient. The Federal Reserve is likely close to the end of the hiking cycle, as inflation has moderated from multi-decade highs. While volatility may continue, we believe portfolio allocations are thoughtfully constructed to provide resiliency and positioned to help investors meet long-term objectives in a variety of market scenarios.

Here’s what matters: Fed interest rate policy is driving the conversation right now. Its attempts to fight off inflation have some worried that the economy could tip into a recession, which could hurt financial markets. Stock prices reflect expectation of future corporate earnings, and in a recession, less earnings growth is likely.

What now? For the last 30 years, we have seen a low-interest rate environment, which has given us relative economic stability. But it’s possible now that things could get bumpy as the Fed fights inflation and the federal government continues to borrow to finance deficit spending. Increased borrowing at higher rates could also prompt Washington to raise taxes to address its budget deficits. Higher interest rates and higher taxes are not a recipe for an economic boom.

- We expect companies with less debt and leverage to outperform in a higher interest rate environment. Stock picking, therefore, is going to be very important. That’s why we at Azzad believe in active portfolio management, especially when you’re screening out large segments of a benchmark due to Islamic screens.

- For some, this new uncertainty could mean it’s time to reassess risks and shift assets to shorter-term less volatile assets like the Azzad Wise Capital Fund, which now yields much more than it did recently.

- For others with longer time horizons, stocks are still often the smart choice, but it’s more important now to have deep conversations with your advisor to help you figure out and try to manage your risk exposure.

Bottom line: Don’t forget these are all short-term market conditions that you shouldn’t be basing your long-term goals like retirement planning on. Nobody knows the future. And nobody can control the many forces that shape markets and the broader economy, but understanding the risk environment and the tools available to help manage it can give all investors greater peace of mind.

Thank you for your continued trust and investment.

This article contains forward-looking statements including statements regarding our current expectations and belief with respect to market conditions. Readers are cautioned not to place undue reliance on these forward-looking statements. Forecasts are subject to uncertainty.