With the wide variety of stocks in the market, figuring out which ones you want to invest in can be a challenging task. Bull markets — periods in which prices as a group tend to rise — and bear markets — periods of declining prices — can lead investors to make irrational choices. Having objective criteria for buying and selling, like those in a financial plan, can help you avoid emotional decision-making.

Most people would much prefer to have a professional do the work of researching specific investments, like our lineup of institutional money managers. But it can still be helpful to understand the concepts that these professionals use in evaluating and buying stocks.

There are generally two schools of thought about how to choose stocks that may be worth investing in. Value investors generally buy stocks that appear to be bargains relative to the company’s intrinsic worth. The companies are often older and more established. Growth investors prefer companies that are growing quickly (think information technology) and are less concerned with undervalued companies than with finding companies and industries that have the greatest potential for appreciation in share price.

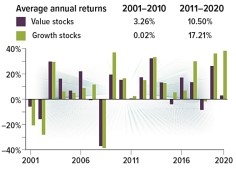

Value and growth stocks tend to perform differently under different market conditions (see chart below). Growth stocks have dominated the market for the last decade, led by tech giants and other fast-growing companies. While it’s possible this trend may continue, some analysts think that value stocks may have strong appeal during the economic recovery.

Source: FTSE Russell, 2021, for the period 1/1/2001 to 12/31/2020. Value stocks and growth stocks are represented by the Russell 1000 Value Index and the Russell 1000 Growth Index, respectively. The performance of an unmanaged index is not indicative of the performance of any particular investment. Individuals cannot invest directly in an index. Investment fees, charges, and taxes were not taken into account and would reduce the performance shown if they were included. Rates of return will vary over time, particularly for long-term investments. Past performance is no guarantee of future results. Actual results will vary.

No one can predict the market, of course. And past results are never a guarantee of future performance. But for the sake of diversification, it may be wise to hold both value and growth stocks in your portfolio. Consider reviewing your portfolio with an Azzad financial advisor to see how you’re allocated.

Diversification is a method used to help manage investment risk; it does not guarantee a profit or protect against loss. The return and principal value of stocks, mutual funds, and ETFs fluctuate with changes in market conditions. Shares, when sold, may be worth more or less than their original cost. The amount of a company’s dividend can fluctuate with earnings, which are influenced by economic, market, and political events. Dividends are typically not guaranteed and could be changed or eliminated.