Debt markets in Gulf Cooperation Council (GCC) countries have historically been unable to qualify for inclusion in emerging-market fixed income indexes or any other major fixed income index, which has resulted in lost investment in the region. But that’s all about to change.

Next year, GCC countries are slated for inclusion in the prominent J.P. Morgan Emerging Market Bond Index (EMBI), marking a high water point for both the region and the larger fixed income universe.

J.P. Morgan is planning to add sovereign and quasi-sovereign debt issuers from Saudi Arabia, Qatar, the United Arab Emirates, Bahrain, and Kuwait to the index between January 31 and September 30, 2019. This change will bring all GCC member states into the index, which is a key performance benchmark for emerging market investors.

According to J.P. Morgan’s analysis, the GCC region could represent 12 percentage points in the index by the time the new GCC countries are phased in, which means upwards of $20 billion in cash inflows into the region. This could bring total index representation from the Middle East up to 18%, putting it on the same level as emerging markets in other regions like Europe (22%) and Asia (17%).

Why the addition?

J.P. Morgan’s criteria for inclusion in the EMBI previously required a per capita gross national income under $18,769 and a below-investment-grade credit rating for three consecutive years. With its low gross domestic product (GDP), the only GCC country currently in the EMBI is Oman. The remaining GCC countries have higher income levels than most other emerging markets economies, and their debt is solidly investment grade.

The new EMBI criteria will use a purchasing power parity ratio, which can allow a country to be included even if its gross national income is above the ceiling or if its credit rating is already investment grade.

J.P. Morgan adjusted its criteria for both practical and financial reasons. First, emerging markets changed faster than J.P. Morgan could keep up. In order to be taken seriously as a fair representation of the emerging market space, the EMBI could not ignore the growing and liquid GCC asset class on GDP and debt rating grounds alone. So the firm revisited the classification criteria and expanded them in order to include the GCC region and reflect this changing reality.

Second, in response to massive issuances out of the region in recent years, the actively managed emerging markets investment community bought up cheap GCC debt to further diversify portfolios. These out-of-the-index bets left those in the increasingly important passively managed space at a disadvantage. Not wanting to miss out on the opportunities afforded by the GCC region, investors — who pay hefty sums to J.P. Morgan in the form of fees — lobbied hard to broaden EMBI inclusion criteria.

Prospects for the GCC

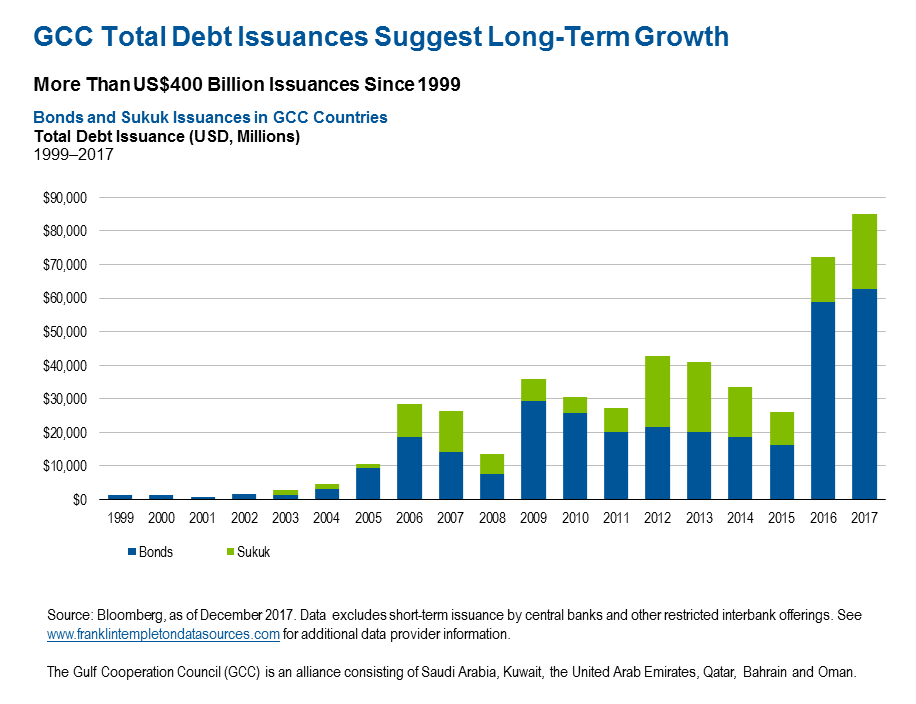

The GCC bond market, which now stands at more than $400 billion USD, has taken a remarkable turn over the last decade thanks to the volume of issuances. Last year, for the first time, all six GCC members had bonds outstanding in international debt markets (both traditional bonds and sukuk).

A record-breaking issuance of $85 billion USD in 2017 came as part of the region’s evolution away from reliance on oil and toward diversified non-hydrocarbon sectors of their economies. The fact that this comes on the heels of the oil price collapse of 2015 is not a coincidence. Regional monarchs made it their stated aim to begin diversifying away from fossil fuels as oil price volatility surged. Lower prices along with generous state subsidies require tapping bond markets in order to balance budgets and, if necessary, fund current account deficits.

The result: GCC members have more than 160 issuers that have entered the debt market. In addition, its growing corporate sector today represents approximately 16% of emerging market external corporate debt—more than Latin America or emerging Europe.

Industry analysts expect the GCC region to become a leader in the Eurobond market and the Shariah-compliant sub-segment of that market. Both Eurobonds and sukuk continue to attract attention from yield-seeking investors. Given the GCC region’s generally attractive yields per unit of duration and high credit ratings, the demand for GCC bonds remains solid.

Risks and rewards

The development of the GCC’s financial markets is not without risks. The region remains volatile, as the Saudi-led blockade of Qatar continues to stymie hopes for a unified trading bloc.

Investors worried that GCC bonds could be adversely affected by geopolitical events and oil price shocks, however, should take heart that GCC bonds typically have had a low correlation to oil prices and to other fixed income assets. Indeed, the potential opportunities for risk-adjusted returns and portfolio diversification may outweigh other risks.

Despite perennial turbulence in the region, as the GCC member economies reform, their inclusion in the EMBI boosts prospects for both local development and greater fixed income diversification for investors.