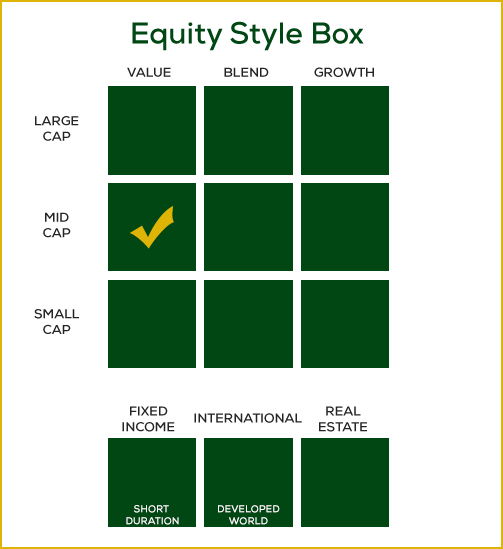

Mid Cap Value Portfolio

We manage our mid cap value portfolio in-house at Azzad.

Part of the Azzad Ethical Wrap Program

A comprehensive halal wealth management solution for high net worth clients, organizations, and business owners.

PERFORMANCE

*Quarter and year-to-date returns are not annualized.

**Performance inception date is 3/1/2009.

*Performance period for 2009 is 3/1/2009 – 12/31/2009

Performance inception date is 3/1/2009. From 3/1/2009 to 1/15/2015 the Mid Cap Value model was managed by Pekin Singer Straus Asset Management. From 1/15/2015 to the present, it is managed by Azzad Asset Management. Between 1/15/2015 and 1/1/2017, the model was managed as part of Azzad’s Dividend Model. The performance is reported in U.S. dollars. The performance quoted represents past performance, which does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Net returns are reduced by all fees, transaction costs and are gross of foreign withholding taxes. Performance includes reinvestment of dividends and other earnings. Gross returns are gross of all fees and transaction costs. For more recent quarter-end performance information, call 888.862.9923. The Russell MidCap® Value Index measures the performance of the mid cap value segment of the U.S. equity universe. It includes those Russell MidCap® Index companies with lower price-to-book ratios and lower forecasted growth values. The index is unmanaged, and does not reflect the deduction of expenses, which have been deducted from the model’s returns. The index’s return assumes reinvestment of all distributions and dividends; you cannot invest directly in an index.

TOP 5 MID CAP VALUE HOLDINGS

as a percentage of the total portfolio

| Pioneer Natural Resources Co | 5.09 |

| Agilent Technologies Inc | 4.91 |

| EOG Resources Inc | 4.83 |

| Trane Technologies PLC Class A | 4.39 |

| Sysco Corp | 4.37 |

As of 9/30/2023. For illustrative purposes only; subject to change. Model portfolio holdings and allocations are subject to change and are not a recommendation to buy or sell any security.

SECTOR WEIGHTS

as a percentage of the total portfolio

As of 9/30/2023. For illustrative purposes only; subject to change. Figures may not equal 100% due to rounding.

WHAT ARE MID CAP VALUE STOCKS?

Mid cap stocks are shares of companies that fall between large-cap and small cap companies in terms of market capitalization (the total market value of all their shares). Different managers use different dollar amounts in their definitions of mid cap, but in general mid caps are companies with a market cap between $2 billion and $10 billion.

Mid cap companies also tend to fall between large and small cap companies in terms for risk and volatility. They may be somewhat more volatile than their large-cap counterparts, but they also still have room to grow, which could mean bigger returns.

Mid cap value stocks are companies in this category that analysts believe to be under-valued, meaning their stock prices are lower than what they could be based on the fundamentals of the companies.

THE MID CAP VALUE PORTFOLIO MANAGER

Azzad Asset Management is a registered investment adviser headquartered in the suburbs of Washington, D.C.

Azzad is committed to managing clients’ money according to a socially responsible investment philosophy based on faith-based values and incorporating a rigorous and disciplined investment approach.

Azzad believes that companies operating in ethical lines of business offer relatively less business risk and are in a better position to thrive in the long-term. The firm’s proprietary screening process allows the manager to prudently manage client assets in a manner consistent with their values.

OBJECTIVE & STRATEGY

Azzad’s Mid Cap Value Portfolio is passively managed according to its benchmark, the Russell MidCap® Value Index.

Historically, mid cap stocks have offered higher rates of return than large cap stocks but lower rates of return than small-cap securities. Mid cap stocks have also been more volatile than large cap stocks but less volatile than small cap stocks.

The portfolio generally holds fewer than 40 stocks.

Portfolio Facts

Inception date: March 1, 2009

Asset class: Mid cap value

Portfolio manager: Azzad Asset Management

Benchmark: Russell MidCap® Value Index

Azzad Ethical Wrap Program minimum investment: $500,000

For more information: 888-862-9923

INVESTMENT PROCESS

When building this portfolio, Azzad screens the companies in the Russell MidCap® Value Index through its proprietary halal investing software, first removing stocks with unacceptable primary business activities.

The remaining stocks are evaluated according to several financial filters to remove companies whose debt or interest-income ratios run afoul of halal screens.

ACCESS THIS STRATEGY

Our mip cap value portfolio is offered through the Azzad Ethical Wrap Program.

The minimum initial investment for the program is $500,000.

If you’d like to learn more, please contact us and one of our financial advisors can help you decide if the wrap program is a good fit for your needs.

IMPORTANT INFORMATION

Investing involves risk, including the possible loss of principal. Please read the following important disclosures.

Mid cap stocks could fall out of favor and returns would subsequently trail returns from the overall stock market. Investing in dividend yielding stocks could fall out of favor and returns would subsequently trail returns from the overall stock market.

Moreover, to the extent that a portfolio favors a growth style, the risk is that the values of growth securities may be more sensitive to changes in current or expected earnings than the values of other securities. To the extent a portfolio uses a value style, the risk is that the market will not recognize a security’s intrinsic value for a long time, or that a stock judged to be undervalued may actually be appropriately priced.

Investments in securities involve risks and there is no guarantee that a strategy will achieve its objectives. As with all stock investments, you may lose money investing in a portfolio. Azzad’s portfolios generally avoid companies in certain economic sectors and businesses due to Azzad’s socially responsible investment restrictions. Therefore, their performance may suffer if these sectors and/or businesses outperform the overall stock market.

Each portfolio is nondiversified and may invest a larger percentage of its assets in fewer companies exposing it to more volatility and/or market risk than a diversified portfolio. Each portfolio is generally available only through one of Azzad’s asset allocation strategies and is not designed by itself to be a comprehensive, diversified investment plan.

All of Azzad’s models are actively managed. Active trading of securities may increase your account’s short-term capital gains or losses, which may affect the taxes you pay. Short-term capital gains are taxed as ordinary income under federal income tax laws. When reviewing your actual performance, holdings and asset allocation, note that different accounts, even though they are traded pursuant to the same strategy, can have varying results. The reasons for this include: i) the period of time in which the accounts are active; ii) the timing of contributions and withdrawals; iii) the account size; iv) the minimum investment requirements and/or withdrawal restrictions; and v) the actual fees charged to an account. There can be no assurance that an account opened by any person will achieve performance returns similar to those provided on this page.

You should consider investing in the Ethical Wrap Program if you are looking for long-term returns and are willing to accept the associated risks. The Ethical Wrap Program is made available through a Wrap Brochure which contains important information about our firm, strategies, risks and conflicts of interest. Please request a copy of our Wrap Brochure, Part 2A of the firm’s Form ADV and your representative’s Part 2B by calling 888.862.9923 before investing in the Wrap Program or opening an account with us.

Azzad Asset Management is an independently registered investment adviser. Azzad Asset Management claims compliance with the Global Investment Performance Standards (GIPS®). To obtain GIPS-compliant performance information including a GIPS Composite Report for the firm’s strategies and products, please call 888.862.9923 or send an email to info@azzad.net.