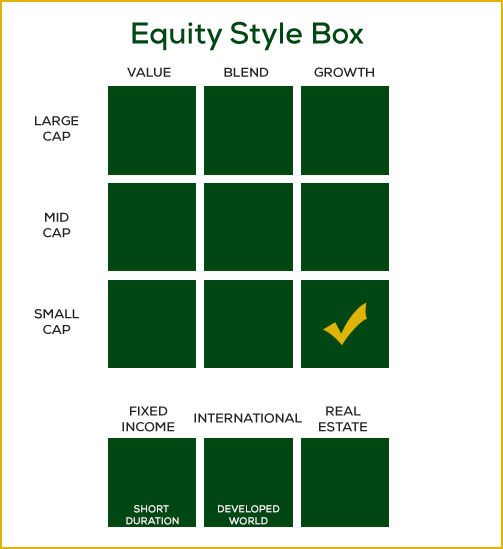

Small Cap Growth Portfolio

Azzad’s small cap growth portfolio is managed by Kayne Anderson Rudnick Investment Management.

Part of the Azzad Ethical Wrap Program

A comprehensive halal wealth management solution for high net worth clients, organizations, and business owners.

PERFORMANCE

Quarter and year-to-date returns are not annualized.

Performance inception date is 8/1/2013.

Performance inception date is 8/1/2013. The performance is reported in U.S. dollars. The performance quoted represents past performance, which does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Net returns are reduced by all fees, transaction costs and are gross of foreign withholding taxes. Performance includes reinvestment of dividends and other earnings. Gross returns are gross of all fees and transaction costs. For more recent quarter-end performance information, call 888.862.9923. The Russell 2000® Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values. The index is unmanaged, and does not reflect the deduction of expenses, which have been deducted from the model’s returns. The index’s return assumes reinvestment of all distributions and dividends; you cannot invest directly in an index.

TOP 5 SMALL CAP GROWTH HOLDINGS

as a percentage of the total portfolio

| Fox Factory Holding Corp | 14.14 |

| Morningstar Inc | 12.98 |

| AAON Inc | 11.62 |

| BILL Holdings Inc Ordinary Shares | 9.27 |

| Ncino Inc Ordinary Shares | 8.44 |

SECTOR WEIGHTS

as a percentage of the total portfolio

As of 9/30/2023. For illustrative purposes only; subject to change. Figures may not equal 100% due to rounding.

WHAT ARE SMALL-CAP GROWTH STOCKS?

Small cap stocks are shares of companies with relatively small market capitalization (the total market value of all their shares). Different managers use different dollar amounts in their definitions of small cap, but in general small-caps are companies with a market cap between $300 million and $2 billion.

Small cap companies tend to be more risky and volatile than their large cap counterparts, but they also have more room to grow, which could mean bigger returns.

Small cap growth stocks are companies in this category that analysts believe will grow at an above average rate.

MEET THE MANAGERS

Kayne Anderson Rudnick Investment Management was founded in 1984 by two successful entrepreneurs, Richard Kayne and John Anderson, to manage the funds of its principals and clients.

John Anderson was a prominent Los Angeles attorney and businessman, a member of the Forbes 400, and the named benefactor of the Anderson School of Business at UCLA.

Headquartered in Los Angeles, the firm is wholly owned by Virtus Investment Partners (NASDAQ: VRTS).

History of the manager was provided by Kayne Anderson Rudnick.

Todd Beiley, CFA®

Portfolio Manager

Jon Christensen, CFA®

Portfolio Manager

OBJECTIVE & STRATEGY

Azzad’s Small Cap Growth Portfolio seeks to achieve a return equal to or greater than its benchmark, the Russell 2000® Growth Index after screening for Azzad’s ethical screens.

The portfolio manager is Kayne Anderson Rudnick Investment Management (KAR). KAR’s investment philosophy focuses on the high-quality subset of the small cap asset class. KAR believes that this emphasis on high-quality businesses, anchored by fundamental, bottom-up research, will achieve attractive risk-adjusted returns for its clients over a complete market cycle.

KAR defines “high quality” as a business characteristic that represents a company’s ability to control its market. This investment philosophy leads KAR to companies which it believes have low business risk as identified by certain financial characteristics, such as consistent and profitable growth, high returns on capital, strong free cash flow, and low organic need for external financing.

Portfolio Facts

Inception date: August 1, 2013

Asset class: Small cap growth

Portfolio manager: Kayne Anderson Rudnick Investment Management

Investment approach: Bottom-up

Benchmark: Russell 2000® Growth Index

Azzad Ethical Wrap Program minimum investment: $500,000

For more information: 888-862-9923

INVESTMENT PROCESS

The KAR managers apply a business analyst approach to their research as they strive to develop deep conviction in each of the portfolio holdings and, over time, an information advantage.

KAR believes that owning a focused yet diversified portfolio of companies with low business risk, purchased at attractive valuations, and prudently managed as dictated by changes in fundamentals or valuation, will lead to repeatable and successful investment results.

ACCESS THIS STRATEGY

Our small cap growth portfolio is offered through the Azzad Ethical Wrap Program.

The minimum initial investment for the program is $500,000.

If you’d like to learn more, please contact us and one of our financial advisors can help you decide if the wrap program is a good fit for your needs.

IMPORTANT INFORMATION

Investing involves risk, including the possible loss of principal. Please read the following important disclosures.

Small stocks may be very sensitive to changing economic conditions and market downturns. Small, less seasoned companies and medium-size companies often have greater price volatility, lower trading volume, and less liquidity than larger, more-established companies. These companies tend to have small revenues, narrower product lines, less management depth and experience, smaller shares of their product or service markets, fewer financial resources, and less competitive strength than larger companies. They are also more sensitive to purchase/sale transactions and changes in the issuer’s financial condition.

Moreover, to the extent that a portfolio favors a growth style, the risk is that the values of growth securities may be more sensitive to changes in current or expected earnings than the values of other securities. To the extent a portfolio uses a value style, the risk is that the market will not recognize a security’s intrinsic value for a long time, or that a stock judged to be undervalued may actually be appropriately priced.

Investments in securities involve risks and there is no guarantee that a strategy will achieve its objectives. As with all stock investments, you may lose money investing in a portfolio. Azzad’s portfolios generally avoid companies in certain economic sectors and businesses due to Azzad’s socially responsible investment restrictions. Therefore, their performance may suffer if these sectors and/or businesses outperform the overall stock market.

Each portfolio is nondiversified and may invest a larger percentage of its assets in fewer companies exposing it to more volatility and/or market risk than a diversified portfolio. Each portfolio is generally available only through one of Azzad’s asset allocation strategies and is not designed by itself to be a comprehensive, diversified investment plan.

All of Azzad’s models are actively managed. Active trading of securities may increase your account’s short-term capital gains or losses, which may affect the taxes you pay. Short-term capital gains are taxed as ordinary income under federal income tax laws. When reviewing your actual performance, holdings and asset allocation, note that different accounts, even though they are traded pursuant to the same strategy, can have varying results. The reasons for this include: i) the period of time in which the accounts are active; ii) the timing of contributions and withdrawals; iii) the account size; iv) the minimum investment requirements and/or withdrawal restrictions; and v) the actual fees charged to an account. There can be no assurance that an account opened by any person will achieve performance returns similar to those provided on this page.

You should consider investing in the Ethical Wrap Program if you are looking for long-term returns and are willing to accept the associated risks. The Ethical Wrap Program is made available through a Wrap Brochure which contains important information about our firm, strategies, risks and conflicts of interest. Please request a copy of our Wrap Brochure, Part 2A of the firm’s Form ADV and your representative’s Part 2B by calling 888.862.9923 before investing in the Wrap Program or opening an account with us.

Azzad Asset Management is an independently registered investment adviser. Azzad Asset Management claims compliance with the Global Investment Performance Standards (GIPS®). To obtain GIPS-compliant performance information including a GIPS Composite Report for the firm’s strategies and products, please call 888.862.9923 or send an email to info@azzad.net.