Green sukuk could fill a void in institutional investor portfolios

Last month, Indonesia became the first sovereign green bond issuer in Asia, raising $1.25 billion in a five-year offering. In addition to the distinction of being the first sovereign issuer, Indonesia also made headlines because the product was a sukuk, or Islamic bond. The country’s finance ministry plans to use the proceeds of the green bond to invest in renewable energy projects, green tourism, and waste management.

Although Indonesia is one of the world’s top emitters of greenhouse gases and the largest exporter of coal, it has committed to cutting emissions by at least 29% by 2030 and has set targets to reduce coal use in energy production. The country also aims for renewables to make up nearly one quarter of its energy mix by 2025, up from 12% currently. Plus, around 1,800 megawatts of wind projects are targeted for completion by that time. The green sukuk is expected to help advance these goals.

Few governments have issued green bonds; Poland and France are the biggest. Most other issuers are corporate entities. In Asia, Chinese companies have led the way in tapping the green market to finance environmentally friendly projects, but Indonesia was the first government in the Asia-Pacific region to issue a green bond.

One of the most noteworthy aspects of the Indonesia announcement is that the green bond is structured as a sukuk. Sukuk are Islamically compliant securities backed by a specific pool of assets. Typically, sukuk returns are linked to cash flows generated by the assets purchased or created through the proceeds of the sukuk.

Most sukuk to date have been asset-backed (e.g., infrastructure projects), and credit of the originator has been the decisive factor for ratings. Asset-backed securities are included in the estimated 25-40% of institutional investors’ assets under management that are dedicated to fixed-income debt.

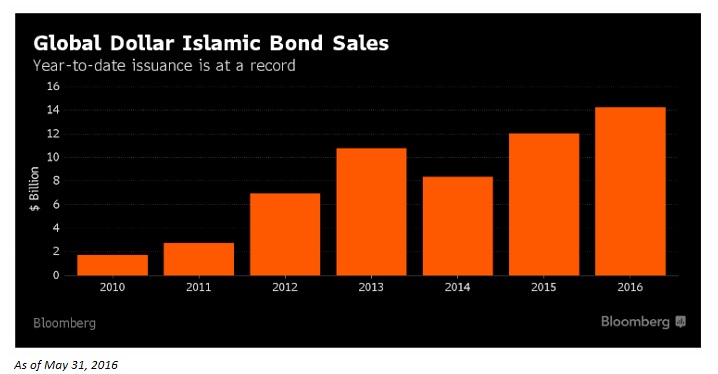

In 2017, green bond issuance reached a record $155 billion, the fifth consecutive year of record issuances according to Moody’s. In contrast, green bond issuance in 2012 amounted to only $2.6 billion. A number of sukuk issuances have been government- or quasi-government backed for rating purposes, but green sukuk are less common. Green sukuk like the one announced last month conform to Islamic finance norms and also fulfill the religion’s imperative to protect the environment.

According to the Climate Bonds Initiative, there is a growing demand for Islamic bonds of all stripes, including green sukuk, but the industry is grappling with a product shortage. The Indonesia deal, for example, was more than two times oversubscribed. Due to “remarkable demand,” pricing was tightened by 30 basis points, reducing the yield to 3.75 percent.

Industry insiders expect further growth in the green bond market this year in part thanks to “greeniums,” where green bonds can be sold at a premium to regular bonds thanks to investor demand.