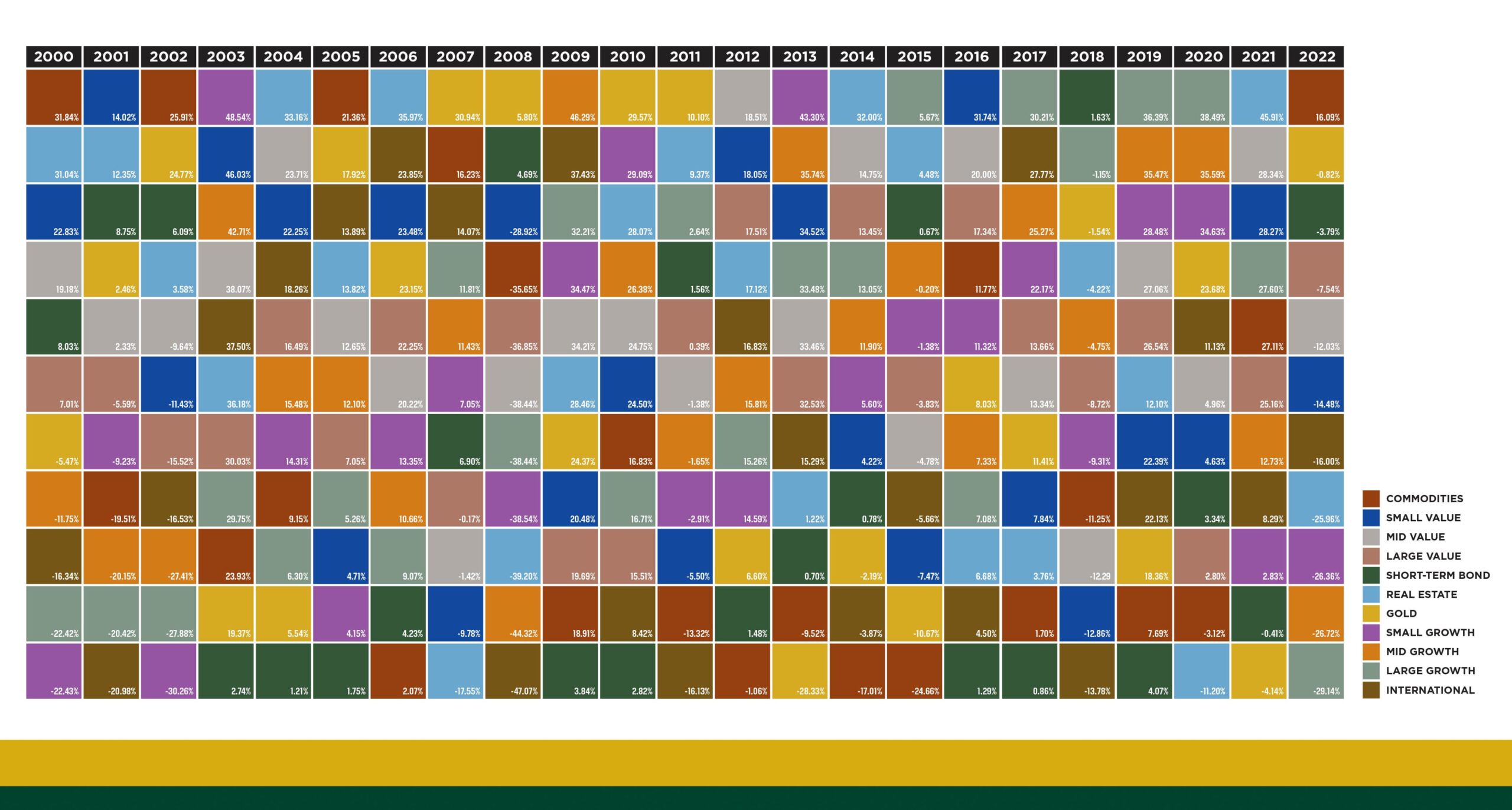

The Importance of Proper Diversification

Source: Morningstar. Data as of 12/31/2021. Past performance is no guarantee of future results. Each index reflects a group of unmanaged securities. It is not possible to invest directly in an unmanaged index. Unless otherwise noted, index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. Diversification, rebalancing and dollar cost averaging are investment strategies that cannot ensure a profit or eliminate the risks of investing. This chart is not indicative of the past, present, or future performance of any Azzad investment products.

Large cap growth stocks are represented by the Russell 1000® Growth Index, which measures the performance of the large cap growth segment of the U.S. equity universe. It includes those Russell 1000® index companies with higher price-to-book ratios and higher forecasted growth values.

Large cap value stocks are represented by the Russell 1000® Value Index, which measures the performance of those Russell 1000® companies with lower price-to-book ratios and lower forecasted growth values.

Mid cap growth stocks are represented by the Russell Midcap® Growth Index, which measures the performance of the mid-cap growth segment of the U.S. equity universe. It includes those Russell Midcap® index companies with higher price-to-book ratios and higher forecasted growth values.

Mid cap value stocks are represented by the Russell Midcap® Value Index, which measures the performance of the mid-cap value segment of the U.S. equity universe. It includes those Russell Midcap® index companies with lower price-to-book ratios and lower forecasted growth values.

Small cap growth stocks are represented by the Russell 2000® Growth Index, which measures the performance of those Russell 2000® companies with higher price to book ratios and higher forecasted growth values.

Small cap value stocks are represented by the Russell 2000® Value Index, which measures the performance of those Russell 2000® companies with lower price-to-book ratios and lower forecasted growth values.

International stocks are represented by MSCI All Country World Index Ex.-U.S. (USD), which is a market-capitalization-weighted index maintained by Morgan Stanley Capital International (MSCI) and designed to provide a broad measure of stock performance throughout the world, with the exception of U.S.-based companies. The MSCI ACWI Ex-U.S. includes both developed and emerging markets.

Real estate is represented by the Dow Jones U.S. Select REIT Index (USD), which tracks publicly traded real estate investment trusts in the U.S.

Short-term bonds are represented by the BofA Merrill Lynch 1-3 Year U.S. Corporate/Government Bond Index.

Commodities are represented by Bloomberg Commodity Index Total Return (USD).

Gold and silver price change is derived from GLD and SLV ETFs (Source: Morningstar).

Data as of 12/31/2022