Investors kicked off September by fleeing stocks, extending the losses suffered in August. This market is being driven by emotion, rather than a substantial change in the fundamentals of the economy. Although data have indicated a slowdown in developed markets, we have seen nothing to indicate a recessionary trend here in the United States. And all indications are that an accommodative Federal Reserve will hold off on a rate hike until at least the end of the year.

What to expect now

September has historically been a challenging month for stocks, and today’s selloff confirmed the stereotype. Although there is no guarantee we’ll continue to see ups and downs like we’ve experienced over the last few weeks, volatility has become more of the norm in markets. That’s due in part to a lot of the uncertainty around Chinese growth and Fed interest rate policy. It’s also healthy. Volatility can be your friend. Without it, you couldn’t make money in the stock market.

Remember that when you own stock in a company, you own part of a business. The value of that business does not fluctuate as wildly on a day-to-day basis as its stock price. This means that its market price at one particular time may not accurately reflect what your ownership stake in the business is worth. When stock prices are affected by outside forces that can temporarily drive down prices, you have an opportunity to pick up quality companies at a bargain. That’s where we come in. Our portfolio managers are focused on quality companies and quality returns—regardless of market environment.

So, we can expect to see more volatility as markets reprice and we adjust to a more normalized monetary policy. If you’re in need of cash within the next couple of years, consider taking some risk off the table. If you’re a longer-term investor, stay the course. Of course, if you’re in it for the long term but still have trouble sleeping at night, we can talk about rebalancing your portfolio to get you back in line with your original asset allocation. And if you’ve got cash sitting on the sidelines, think about deploying it. As legendary investor Warren Buffett says, “Buy when there’s blood in the street.”

The Power of Time

Lots of people talk about the importance of investing for the “long term.” Your own definition of “long term” is most important, and will depend in part on your individual financial goals and when you want to achieve them. A 70-year-old retiree may have a shorter “long term” than a 30 year old who’s saving for retirement.

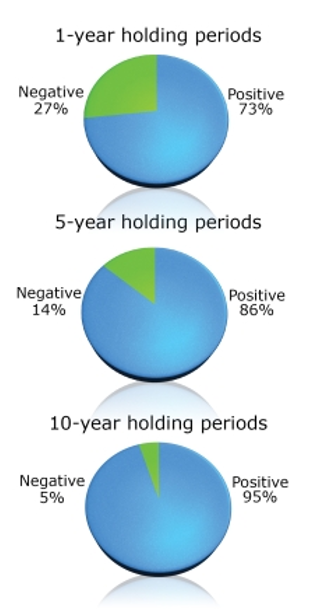

Although any strategy should take into account that the market will not go in one direction forever–either up or down–it’s instructive to look at various holding periods for stocks over the years. Historically, the shorter your holding period, the greater the chance of experiencing a loss. It’s true that the S&P 500 showed negative returns for the two 10-year periods ending in 2008 and 2009, which encompassed both the tech crash and the credit crisis. However, the last negative-return 10-year period before then ended in 1939, and each of the trailing 10-year periods since 2010 have also been positive.*

Here’s a look at the power of time in the market. The odds of achieving a positive return in the stock market have been much higher over a 5- or 10-year period than for a single year. In other words, the longer you hold, the better:

Note: Past performance is no guarantee of future results.

Another study, “Stock Market Extremes and Portfolio Performance 1926-2004,” initially done by the University of Michigan in 1994 and updated in 2005, showed that a handful of months or days account for most market gains and losses. The return dropped dramatically on a portfolio that was out of the stock market entirely on the 90 best trading days in history. Returns also improved just as dramatically by avoiding the market’s 90 worst days; the problem, of course, is being able to forecast which days those will be. Even if you’re able to avoid losses by being out of the market, will you know when to get back in?

*Data source: Calculations by Broadridge based on total returns on the S&P 500 Index over rolling 1-, 5-, and 10-year periods between 1926 and 2014.

Past performance cannot guarantee future results. No investment strategy can eliminate the risk of losses. Asset Allocation, rebalancing and diversification are investment strategies used to help manage risk. They do not ensure a profit or protect against a loss.

Markets continue the roller coaster ride

Markets continue the roller coaster ride

Investors kicked off September by fleeing stocks, extending the losses suffered in August. This market is being driven by emotion, rather than a substantial change in the fundamentals of the economy. Although data have indicated a slowdown in developed markets, we have seen nothing to indicate a recessionary trend here in the United States. And all indications are that an accommodative Federal Reserve will hold off on a rate hike until at least the end of the year.

What to expect now

September has historically been a challenging month for stocks, and today’s selloff confirmed the stereotype. Although there is no guarantee we’ll continue to see ups and downs like we’ve experienced over the last few weeks, volatility has become more of the norm in markets. That’s due in part to a lot of the uncertainty around Chinese growth and Fed interest rate policy. It’s also healthy. Volatility can be your friend. Without it, you couldn’t make money in the stock market.

Remember that when you own stock in a company, you own part of a business. The value of that business does not fluctuate as wildly on a day-to-day basis as its stock price. This means that its market price at one particular time may not accurately reflect what your ownership stake in the business is worth. When stock prices are affected by outside forces that can temporarily drive down prices, you have an opportunity to pick up quality companies at a bargain. That’s where we come in. Our portfolio managers are focused on quality companies and quality returns—regardless of market environment.

So, we can expect to see more volatility as markets reprice and we adjust to a more normalized monetary policy. If you’re in need of cash within the next couple of years, consider taking some risk off the table. If you’re a longer-term investor, stay the course. Of course, if you’re in it for the long term but still have trouble sleeping at night, we can talk about rebalancing your portfolio to get you back in line with your original asset allocation. And if you’ve got cash sitting on the sidelines, think about deploying it. As legendary investor Warren Buffett says, “Buy when there’s blood in the street.”

The Power of Time

Lots of people talk about the importance of investing for the “long term.” Your own definition of “long term” is most important, and will depend in part on your individual financial goals and when you want to achieve them. A 70-year-old retiree may have a shorter “long term” than a 30 year old who’s saving for retirement.

Although any strategy should take into account that the market will not go in one direction forever–either up or down–it’s instructive to look at various holding periods for stocks over the years. Historically, the shorter your holding period, the greater the chance of experiencing a loss. It’s true that the S&P 500 showed negative returns for the two 10-year periods ending in 2008 and 2009, which encompassed both the tech crash and the credit crisis. However, the last negative-return 10-year period before then ended in 1939, and each of the trailing 10-year periods since 2010 have also been positive.*

Here’s a look at the power of time in the market. The odds of achieving a positive return in the stock market have been much higher over a 5- or 10-year period than for a single year. In other words, the longer you hold, the better:

Note: Past performance is no guarantee of future results.

Another study, “Stock Market Extremes and Portfolio Performance 1926-2004,” initially done by the University of Michigan in 1994 and updated in 2005, showed that a handful of months or days account for most market gains and losses. The return dropped dramatically on a portfolio that was out of the stock market entirely on the 90 best trading days in history. Returns also improved just as dramatically by avoiding the market’s 90 worst days; the problem, of course, is being able to forecast which days those will be. Even if you’re able to avoid losses by being out of the market, will you know when to get back in?

*Data source: Calculations by Broadridge based on total returns on the S&P 500 Index over rolling 1-, 5-, and 10-year periods between 1926 and 2014.

Past performance cannot guarantee future results. No investment strategy can eliminate the risk of losses. Asset Allocation, rebalancing and diversification are investment strategies used to help manage risk. They do not ensure a profit or protect against a loss.

Recent Posts

Don’t Send Your Child Off to College Without These Four Tools

How To Reclaim an Inactive 401(k)

How To Estimate Your Retirement Income Needs

Volatility strikes back

Making Best Use of Your Behavioral Biases for Retirement Saving

3 Ways to Apply the 80/20 Rule to Your Financial Pursuits

Ask these 3 questions when shopping for an investment

College protestors are right. We should know what we own.

Halal fixed income investing in a ‘higher-for-longer’ market

Azzad offers condolences on the death of renowned scholar Dr. Mohamad Adam El-Sheikh