Investing for Retirement

We make retirement planning easy.

Learn about investing for retirement

Your choices today determine what kind of lifestyle you’ll have tomorrow. Ideally, you and your loved ones will want to start saving as early as possible to put the power of time and compounding on your side.

Procrastination can cost you significant money. That’s why savvy investors take advantage of time by investing early and consistently, as illustrated by our hypothetical example.

Before you get started, we invite you to learn about investing for retirement, including the impact of time on your investments, the difference between saving in a taxable versus a tax-deferred account, and annual contribution limits for different kinds of retirement accounts.

Let’s Get Started

Begin by determining your retirement income needs. Many experts recommend 60% to 70% of your pre-retirement income, but that is only an estimate. Use your current expenses to help estimate your annual retirement expenses, and don’t forget to allow for future inflation. Potential family and community needs may also be weighed in.

Next, inventory your estimated future assets and income. These may include Social Security, employer-sponsored retirement plans, family support and other sources. The gap between your future needs and the income provided by other sources will have to come from personal savings.

Maximize your tax-deferred retirement savings options

Carefully consider your tax-advantaged retirement savings choices. Employer-sponsored retirement plans are a great place to start. You may also be able to take advantage of a combination of IRA plans. It all depends on your situation. One thing is clear: saving in a tax-advantaged retirement plan can be a powerful way to build your retirement nest egg.

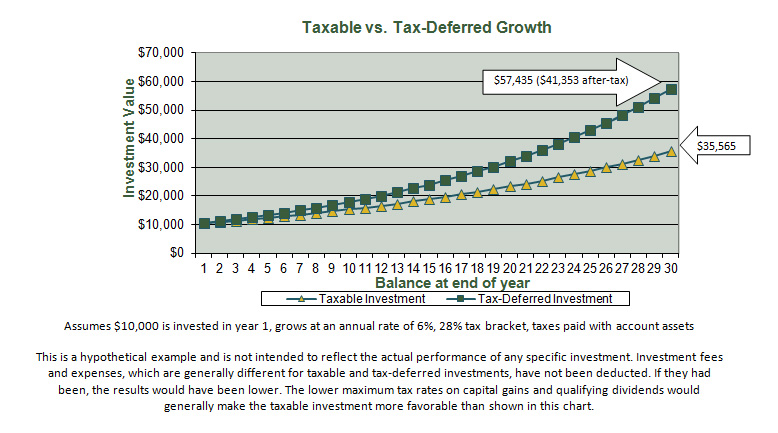

Let’s assume you have $20,000 to invest. You put $10,000 into a taxable account that earns 6% per year, and use a portion of these assets to pay taxes attributable to the account’s earnings. You put the other $10,000 into a tax-deferred account such as a 401(k) that also earns 6% per year. Assuming that you’re in the 28% tax bracket, in 30 years your taxable account will be worth about $35,500, while your tax-deferred account will be worth over $57,000. That’s a difference of over $21,000.

Even if the funds invested in the tax-deferred account are subject to federal income tax upon withdrawal–as they would be if you made pretax contributions to a 401(k)–you would come out ahead. This is true even if you took the entire amount in the tax-deferred account as a lump-sum distribution after 30 years and paid tax on the full amount (at 28% tax, you’d end up with a little over $41,000). Of course, most individuals draw on their retirement savings gradually during their retirement years–when they may be in a lower tax bracket–rather than taking a large lump-sum distribution.

Employee/individual contribution limits

1 Must aggregate employee contributions to all 401(k), 403(b), SAR-SEP, and SIMPLE plans of all employers. 457(b) plan contributions are not aggregated. For SAR-SEPs, the percentage limit is 25% of compensation reduced by elective deferrals (effectively, a 20% maximum contribution).

2 Special catch-up limits may also apply to 403(b) and 457(b) plan participants. Employer contribution/benefit 3 limits

3 For self-employed individuals, compensation generally means earned income. This means that, for qualified plans, deductible contributions for a self-employed individual are limited to 20% of net earnings from self-employment (net profits minus self-employment tax deduction), and special rules apply in calculating the annual additions limit. Compensation limits/thresholds

|

Understand your investment options

You can open a traditional IRA or a Roth IRA with Azzad, or roll over an existing retirement account (such as one with a previous employer) into an Azzad account.

Which investments you choose to fund your IRA or 401(k) will determine how your retirement dollars grow. We can help you build a well-diversified account based on your risk tolerance, age, and goals.

When you have a solid plan, you can feel confident about enjoying your golden years with peace and security. If you are nearing retirement or have already retired, we can help you develop investment strategies and withdrawal programs that will potentially help make your money last longer.

With Azzad, you can be confident that your retirement savings account will invest in companies you can respect. We ensure each of our portfolios are in line with your ethical investment philosophy.

Stay on track with regular contributions

A successful plan uses regular, consistent investing to take advantage of market declines and help your long-term goals remain secure.

Setting up your account for electronic funds transfer (EFT) is an easy way to invest regularly. Just tell us how much money you would like deducted from your bank account and how often, and your money will be automatically invested in your account.

Another benefit of electronic funds transfer is the opportunity to take advantage of dollar-cost averaging. Dollar-cost averaging means investing the same amount of money on a regular basis, so that you automatically buy more shares of a security when the share price is low and fewer shares when the price is high. Over time, this strategy can lower your average price per share. Although it cannot guarantee a profit, dollar-cost averaging may help reduce your risk and potentially increase your long-term returns over time. It can’t protect you from a loss, especially in a declining market, but this strategy works best for long-term goals such as saving for retirement or a child’s college education.