Asset Allocation

Most investment experts agree that asset allocation plays a key role in the overall performance of your portfolio.

“The function of economic forecasting is to make astrology look respectable.” – Renowned economist John Kenneth Galbraith

Improving Portfolio Performance with Asset Allocation

One of the most important decisions for your investment portfolio is how you choose to allocate your assets. “Asset allocation” refers to how a portfolio is divided among the various types of investments (also known as asset classes) that are available to invest in.

Examples of asset classes include U.S. stocks, bonds, foreign investments, real estate, commodities and alternative assets such as precious metals. Most investment experts agree that asset allocation is an important determinant of portfolio performance.

The underlying principle in asset allocation is the documented observation that different broad categories of investments have shown varying rates of return and levels of price volatility – or risk – over time.

This chart ranks the best to worst performing asset classes from top to bottom from 2000 to 2022. From year to year, there’s no telling which asset classes will be the best performers. By diversifying your investments over multiple asset classes, you potentially reduce risk and volatility, since downturns in one investment class may be tempered or even offset by favorable returns in another.

How you allocate your assets depends on several factors, including your investment objectives, attitudes toward risk and investing, desired return, age, income, time horizon, and even your belief in what the market will do in the near term and long term. Your asset allocation will likely need to adjust over time as your circumstances change.

Example: Let’s say your investment objective is substantial asset growth, you have a 10- to 15-year horizon, and you are willing to assume a high amount of risk. You might choose to place a larger percentage of your assets in stocks (with a higher concentration in small and mid cap stocks) that may offer higher return, but involve a greater degree of risk.

Another investor with a 5-year time horizon, whose objective is preservation of principal and who doesn’t want substantial risk, may invest more heavily in fixed income and large-cap dividend yielding stocks.

Successful investors ignore the impulse of piling all their money into the latest, popular asset class. We believe you can turn any market into a potentially wealth-building opportunity over the long term by properly diversifying, dollar cost averaging and rebalancing your account.

The relationship between risk and return

Risk is inversely related to return. Generally, the higher the risk you are willing to assume, the greater the potential for a higher return and the greater potential for loss.

Investors expect to be rewarded with higher returns in exchange for accepting greater risk and accept lower returns in exchange for lower risk. A major goal in designing and managing an investment portfolio is to maximize total return while keeping overall risk to an acceptable level.

Generally, the higher the expected return on an investment, the higher the risk involved in trying for that return. The longer your investment time horizon, the more volatility you may be able to handle, allocating more of your investments to higher-risk assets and making your portfolio more aggressive.

With a longer investment horizon, you have a better opportunity to ride out several economic cycles. A shorter time frame usually requires a more conservative approach because you have less time to try to recuperate from a market downturn. As the time approaches to convert your investments to cash that can be used for a particular goal, you may want to allocate investments into a lower volatility mix of asset classes.

Correlation: selecting diverse asset classes to reduce risk

Combining a variety of asset classes within a portfolio is called diversification. The goal of diversification is not simply to have many different investments, but to combine complementary investments so that the resulting portfolio offers the best return for the least amount of risk during the investor’s time horizon. To accomplish this, it helps to understand the concept of correlation.

Correlation measures the similarity of investments’ price movements over time. When the prices of two different investments move identically, they are said to have a correlation of 1.0. When the prices move in exactly opposite directions, their correlation is -1.0. A correlation of 0 means that price movements are unrelated to each other, so price movement of one investment is not useful in predicting the price movement of another.

A well-diversified portfolio consists of asset classes that are not closely correlated to each other. For instance, say a portfolio consists of stocks in U.S. companies in the large-cap, mid-cap, and small-cap categories. This portfolio is not well diversified, because historically all classes of U.S. stocks have tended to be closely correlated. The addition of less highly correlated asset classes such as foreign investments, bonds, and real estate securities would add significantly to the diversification of this portfolio.

Diversification can’t guarantee a profit or ensure against a loss, but it can help you manage the types and level of risk you take.

An important note for American Muslim investors:

The options for investing in permissible fixed -income securities are nearly nil.

That is why we created the Azzad Wise Capital Fund to represent this asset class.

Of course, clients are not charged a separate program fee when their strategy is invested in our proprietary mutual fund.

Clients are charged for any fees charged by the Fund.

Please download and read the Fund’s prospectus for more information.

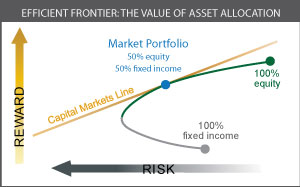

The Efficient Frontier

Azzad’s Ethical Wrap Program is based on an award winning investment strategy called “Modern Portfolio Theory (MPT)”.

This theory incorporates a concept called the efficient frontier.

This theory incorporates a concept called the efficient frontier.

It examines the relationship between risk and return for various investment portfolios. The efficient frontier can be expressed as a curved line on a graph. The graph plots risk, expressed as standard deviation, on the horizontal axis and return on the vertical axis.

The efficient frontier line is comprised of the points on the graph that represent where risk is minimized for a given rate of return and where return is maximized for a given degree of risk. In other words, portfolios that fall along the efficient frontier are said to be optimized (known as mean variance.

Monitoring and rebalancing your asset allocation

As noted earlier, your asset allocation may change over time; what was appropriate in the past may not be right today, and what works today may not be appropriate for you in the future. This can be the result of economic conditions or changes in your circumstances and/or investment objectives.

Your Azzad financial advisor will work with you to determine if your asset allocation strategy is appropriate for your financial situation.

Our investment team strives to anticipate opportunities in the global markets. Based on our macroeconomic analysis, we tactically rebalance our strategies to ensure that they are appropriately aligned to take advantage of market movements. As a result, your strategy’s asset allocation may change over time.

In addition, growth or decline within asset classes may cause your asset allocation ratios to shift. For this reason, we monitor our asset allocation strategies periodically and rebalance your portfolio as needed.

Rebalancing your portfolio involves shifting funds from one asset class to another to return to the ratios we have determined are appropriate for your investment portfolio. It’s a strategy designed to control your emotions especially when the markets are unusually volatile.

Example(s): Let’s say that on January 1, your account was invested in our Global Moderate Aggressive Strategy. According to this strategy, 85 percent of your assets are in stocks (further diversified among large, small, mid, real estate, precious metals, and so forth), and 15 percent is in our fixed income portfolio represented by the Azzad Wise Capital Fund.

At the end of a year, the stock market has done very well, and as a result, you discover that your ratios have shifted.

Now, 95 percent of your portfolio’s value is in stocks, and 5 percent is in fixed income, even though you have made no changes in your investments. Based on our investment team’s research and market conditions, we would automatically rebalance your account. Rebalancing will result in us selling some stock and investing the proceeds in fixed income.

The opposite would be true if stocks sank; you might sell another asset class and invest enough in stocks to return to your original percentage.

Alternatively, you could direct any new cash you are able to invest into asset classes that now represent a lower percentage of holdings than you prefer.