As your family’s wealth grows, you may start to prioritize giving back to your community. Cultivating philanthropic values can help foster responsibility and a sense of purpose among both young and old alike, while fulfilling your financial goals. Charitable donations may be eligible for income tax deductions (if you itemize) and can help reduce capital gains and estate taxes. Here are four ways to incorporate charitable giving into your family’s overall financial plan.

Start the tradition of annual family giving

End of year presents a perfect opportunity to establish an annual family giving plan. Begin by determining the total amount that you’d like to donate to charity. Next, encourage your family members to research and make a case for their favorite nonprofit organization, or divide the total amount equally among your family members and have each person donate to his favorite cause.

Need help choosing a charity? Consider how efficiently the contribution dollars are used — in other words, how much of the organization’s total annual budget directly supports programs and services versus overhead, administration, and marketing. The Charity Navigator web site, charitynavigator.org can provide you with this and other information.

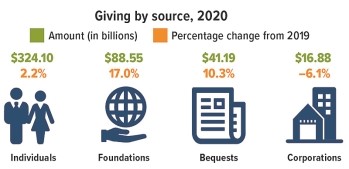

Snapshot of 2020 Giving

Despite the pandemic and economic downturn, 2020 was the highest year for charitable giving on record, reaching $471.44 billion. Giving to public-society benefit organizations, environmental and animal organizations, and human services organizations grew the most, while giving to arts, culture, and humanities and to health organizations declined.

Work charity into your estate plan

Charitable giving can also play a key role in your estate plan by helping to ensure that your philanthropic wishes are carried out and potentially reducing your estate tax burden.

The federal government taxes wealth transfers both during your lifetime and at death. In 2021, the federal gift and estate tax is imposed on lifetime transfers exceeding $11,700,000, at a top rate of 40%. States may also impose taxes but at much lower thresholds than the federal government.

Wills and trust bequests, beneficiary designations for insurance policies and retirement plan accounts, charitable lead and charitable remainder trusts are some of the ways to incorporate charitable giving into your estate plan. Your Azzad advisor can work with your estate planning attorney to help you incorporate charitable giving into your estate planning.

Remember donor advised funds

Donor advised funds can help you maximize your charitable impact while reducing your tax liability. The fund is owned by a sponsoring charity, but as the donor, you get the right to advise how the account is invested and how the money is distributed. By donating stocks or mutual funds to a donor advised fund, you also can avoid any tax on the appreciation of these assets. Your Azzad advisor can help you understand some of the potential pitfalls to opening a donor advised fund (including account minimums and administrative costs) so be sure to consult with her before you open and contribute to your donor-advised fund.

Consider a family foundation (for well-qualified clients)

Private family foundations are another popular way families conduct their charitable giving. Although you don’t necessarily need the coffers of Melinda Gates or Sam Walton to establish and maintain one, a private family foundation may be most appropriate if you have a significant level of wealth. The primary benefit (in addition to potential tax savings) is that you and your family have complete discretion over how the money is invested and which charities will receive grants. A drawback is that these separate legal entities are subject to stringent regulations.

These are just a few of the ways families can nurture a philanthropic legacy while benefitting their financial situation. For more information, contact your Azzad financial advisor.