The United States has been the most generous country in the world over the past decade, according to the World Giving Index measure of 128 countries.

With all this economic uncertainty, high unemployment and market volatility, what will happen to charitable giving in 2020? Upon evaluation of COVID-19’s impact on charitable donations, we must consider several issues:

Oftentimes, there is a high correlation between charitable giving in America and the GDP. Since the mid-1900s, charitable giving hovered around 2 percent of the annual GDP. That 2 percent even held true following the 2008 financial crisis when it only decreased to 1.9 percent from 2009 through 2011. According to Fannie Mae, the growth forecast for 2020 is -5.4 percent. If we look at the numbers, the 2019 GDP was $21.44 trillion and therefore charitable giving at 2 percent was approximately $450 billion. If the GDP declines by 5.4 percent and giving declines to 1.9 percent, that would be a decrease in charitable giving of $43 billion or roughly 10 percent. This would cause an undue hardship on nonprofit organizations and, in turn, on their beneficiaries.

CARES Act

One mitigating factor is the Coronavirus Aid, Relief, and Economic Security Act or CARES Act, which was signed into law in March. In addition to all the other benefits for Americans, including stimulus checks, small business loans and the pause of Required Minimum Distributions from IRA accounts, the CARES Act has a section that encourages charitable giving to nonprofits. It includes some revisions to the Internal Revenue Code intended to encourage charitable giving, particularly of cash donations and food. This Act recognizes the need for charities to receive donations during the pandemic. This is often accomplished by giving additional tax benefits to taxpayers who support charities. Some benefits for charitable donors in the CARES Act include:

- New Deduction: For taxpayers who take the standard deduction, up to $300 per taxpayer ($600 for a married couple) in annual charitable contributions are permitted. This must be given directly to a charity. Donations to donor advised funds (DAF) will not qualify for this deduction.

- New Charitable Deduction Limits: For taxpayers who itemize their tax return, they can elect to deduct donations up to 100 percent of their 2020 AGI (up from 60 percent previously). Corporations may deduct up to 25 percent of taxable income (up from 10 percent previously). These donations, like the ones for taxpayers claiming standard deductions, must be given to a public charity and not a DAF.

- Food Inventory Deduction: In addition to cash donations, the CARES Act incentivizes food donations by increasing the deduction from 15 percent to 25 percent.

How 2020 is shaping up

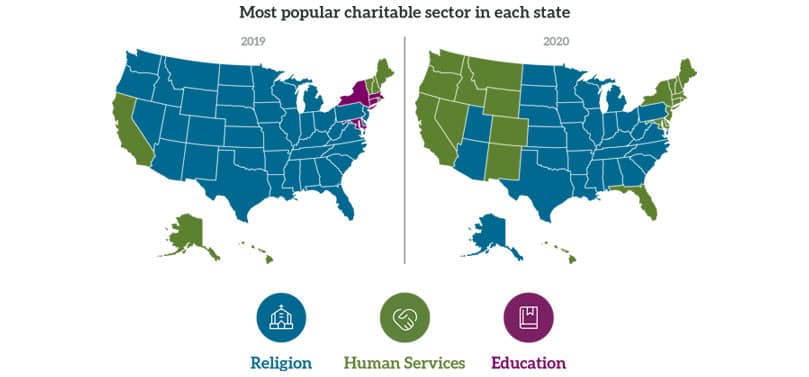

So how have charitable donations been affected to date in 2020? According to Fidelity Charitable’s Communities in Crisis report released near the end of the second quarter, in the first four months of 2020, donors nationwide recommended 544,000 grants totaling $2.4 billion, which is an increase of 16 percent from the same time period in 2019. A separate study by the Community Foundation Public Awareness Initiative tracked grants at 32 community foundations from March to May 2020 and found an increase in grants of 80 percent from the same time period in 2019. We cannot make an assessment as to the specific reasons for each donor’s increase, but a combination of the CARES Act incentives and the heightened willingness to help those in need motivated by the pandemic are sure to be a few of the major reasons for such generosity. Thus far in 2020, the most popular charitable sector in the U.S. was human services, whereas religion was the most popular sector in 2019.

Source: Fidelity Charitable June 2020

Grants to foodbanks and other food assistance programs were up 667 percent nationally. These statistics in gifting trends of 2020 fall in line with other times of crisis when we find that people look to their places of worship, food pantries and other charitable organizations for help.

Given the unemployment rate and subsequent food insecurity our country is seeing, the surge in charitable gifting is a step in the right direction toward providing solutions to the problems arising from the events of 2020.

If you’d like to learn more about how you can give more in a tax-smart way, talk with your Azzad advisor today.