Only 13% of retirement savers maxed out their 401(k) contributions last year. Were you one of them?

One great thing about saving for retirement in a 401(k) compared to an IRA is that you can contribute much more to the 401(k) account, regardless of your age. This year, you can contribute up to $18,500 if you’re under age 50 or $24,500 if you’re 50 and over.

Even though it’s a great way to help create a secure retirement, a recent report showed that only 13% of 401(k) plan participants maxed out their contributions last year.

Of course, many people don’t have an income that would allow them to invest the maximum amount each year. Yet interestingly, even 60% of people with higher incomes still didn’t max out their allowed contributions.

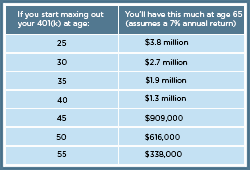

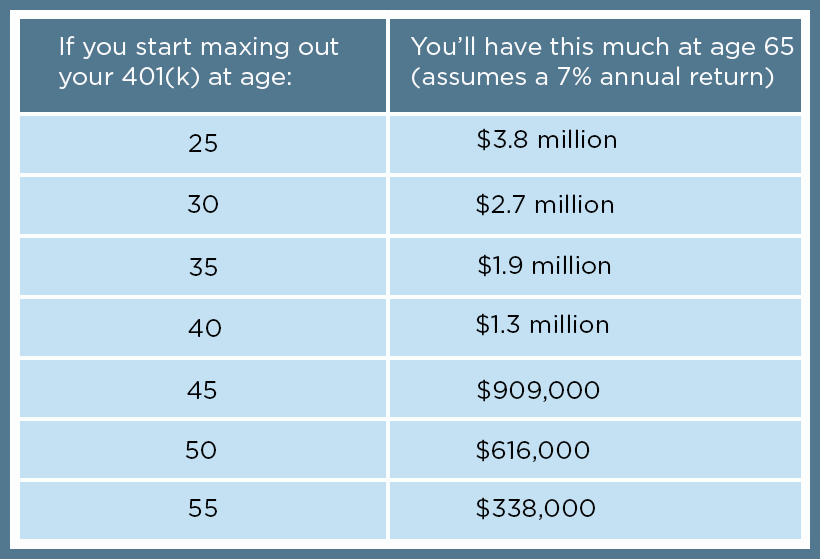

Perhaps those who have the means would be more motivated to save the maximum amount if they understood how much they can build for the future. Let’s take a look at the numbers:

Another thing to keep in mind about these figures is that they’re based on this year’s annual contribution limits. If those thresholds increase in future years, which they’re likely to do, and you keep pace, you stand to retire with even more.As you can see, if you max out your contributions beginning at age 25, you stand to retire with close to $4 million, assuming your investments generate an average annual return of 7% during that time, which is more conservative compared to the stock market’s long-term average.

Maxing out can do wonders for your retirement savings, so don’t miss the opportunity. Your nest egg will thank you.