Burma-focused proposal asks Chevron to evaluate a policy of not doing business with governments engaging in genocide or crimes against humanity

Falls Church, Va., Dec 18, 2017 – A group of investors has filed for the second time a shareholder resolution with Chevron Corporation focused on the persecuted Rohingya minority in Burma (Myanmar). The proposal asks the energy giant to report on the feasibility of enacting a policy of not doing business with governments engaged in genocide or crimes against humanity.

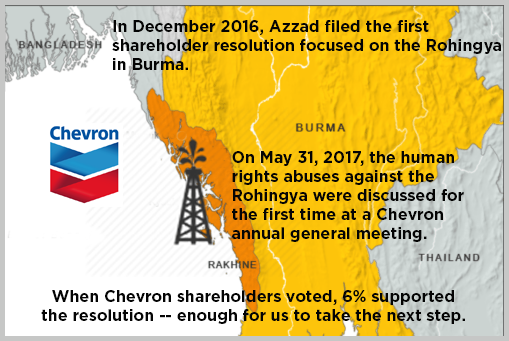

Azzad Asset Management filed the resolution, and at least four other socially responsible investment institutions co-filed. Azzad and the Ursuline Sisters of Tildonk filed a version of this resolution last year. For 2018, it was updated to take into account the heightened atrocities and the resulting mass exodus of Rohingya from Myanmar over the summer and fall. To date, this is the only shareholder resolution focused on the Rohingya submitted to a U.S. corporation.

Through its subsidiary Unocal Myanmar Offshore Co., Ltd., Chevron entered into a production sharing contract with the state-owned Myanma Oil and Gas Enterprise (MOGE) in 2015 to explore for oil and gas in the Rakhine Basin. Rakhine state was until recently the home of most of Burma’s Rohingya population.

The resolution says in part:

“As shareholders, we believe that our company has the duty to avoid the moral, legal, financial, reputational, and operational risks posed by doing business with governments complicit in genocide or crimes against humanity. It is incumbent that our board adopt policies that protect shareholder value from these risks.”

At Chevron’s annual general meeting in May 2017, the original proposal garnered six percent of Chevron shareholder votes. Because the vote tally was greater than three percent in favor, Securities and Exchange Commission (SEC) rules allow the Rohingya resolution to be resubmitted to Chevron for 2018.

In August 2017, a new crackdown by Myanmar’s military drove an estimated 620,000 Rohingya, half of them children, to flee to neighboring Bangladesh. In November 2017, following a visit to the region and analysis of the facts, U.S. Secretary of State Rex Tillerson described the Myanmar army offensive against the Rohingya as “ethnic cleansing” and called for a “credible, independent investigation” of the military’s reported human rights abuses. Tillerson also signaled possible U.S. sanctions against Burma’s army.

See: Myanmar’s Crackdown on Rohingya Is Ethnic Cleansing, Tillerson Says (NY Times)

In August, an investor coalition representing more than $30 billion in assets sent a letter to Chevron asking it to reassess its relationship with the Myanmar government in light of ongoing atrocities. In October, investors with more than $53 billion in assets under management sent similar letters to six other oil and gas companies that also have contracts with MOGE.

After dialogue with shareholders following about that letter, Chevron told BBC News that it will promote “the need to foster a business environment that respects human rights.”

See: Chevron says it will push for Myanmar human rights (BBC)

The U.S. Holocaust Memorial Museum has reported that the Rohingya are “at grave risk of additional mass atrocities and even genocide.” In November 2017, Amnesty International issued a report detailing how Rohingya in Myanmar are subject to a “vicious system of state-sponsored, institutionalized discrimination that amounts to apartheid,” meeting the international legal definition of a crime against humanity.

ABOUT AZZAD

Azzad Asset Management is committed to providing investment services designed to help people enjoy optimum performance without compromising their values. The firm, based outside Washington, DC, is a registered investment advisor that operates with the belief that companies in ethical lines of business offer relatively less business risk and are in a better position to thrive over the long term.

– END –