We’ve been talking a lot about shareholder advocacy at Azzad recently–and about how it’s a largely untapped way for concerned citizens to take action on issues we care about.

For those who aren’t familiar with it, shareholder advocacy refers to actions taken by stock investors (shareholders) to ask the companies whose stock they own to improve or change behavior for the public good. Think of asking an energy company to use more renewables or a technology company to end purchases of conflict minerals. If you invest in stocks, you can participate in shareholder advocacy.

We recently used shareholder advocacy to take action on an issue many people feel isn’t getting the attention it should – the human rights abuses faced by the Rohingya minority in Burma at the hands of its government. In November 2016, the United Nations said that abuses perpetrated against the Rohingya by the Burmese military may amount to crimes against humanity. The U.S. Holocaust Memorial Museum has reported that the Rohingya are “at grave risk of additional mass atrocities and even genocide.”

During the fall filing season, Azzad partnered with a Catholic religious organization, the Ursuline Sisters of Tildonk, to file the first shareholder resolution submitted to a U.S. corporation focused on the plight of the Rohingya people.

During the fall filing season, Azzad partnered with a Catholic religious organization, the Ursuline Sisters of Tildonk, to file the first shareholder resolution submitted to a U.S. corporation focused on the plight of the Rohingya people.

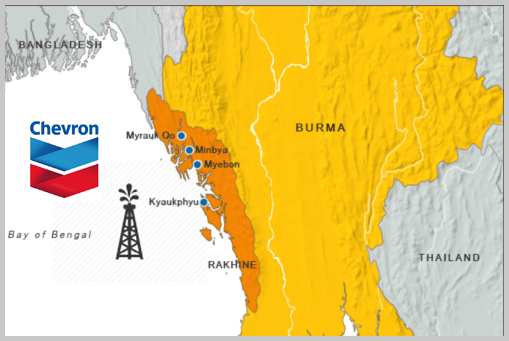

Why Chevron? In 2015, Chevron entered into a contract with the state-owned Myanmar Oil and Gas Enterprise to explore for oil off the coast of the Rakhine state in western Burma. Rakhine is the homeland of more than one million Rohingya people.

The resolution we submitted calls on Chevron to evaluate a policy of not doing business with governments that are believed to be engaged in genocide or crimes against humanity. It specifically proposed that Chevron halt its relationship with the government of Burma until that country ends the state-sanctioned violence against its Rohingya minority. Essentially, it tells Chevron that investors are watching what they do in the Rakhine state and in other areas where human rights abuses are taking place.

Some corporate leaders may care about ethical issues related to their business and others may not; however, the leaders of all publicly traded companies have a legal responsibility to their shareholders to run the company well and do what’s best for the business. Reputational risks from doing business with governments engaged in human rights abuses are a real consideration, and it’s this concern that we appealed to in our proposed resolution.

The resolution will be put to a vote by stockholders at Chevron’s annual meeting in May 2017. As the lead filer, Azzad will send a representative to read a statement to formally “move” the resolution.

Then shareholders – maybe including you – will have a chance to vote on it by using a proxy ballot provided by Chevron. For people who own mutual funds, as many investors do, the mutual fund company will vote on your behalf. (Find out how your mutual fund company votes on differing issues by checking their proxy voting guidelines on their website. Here are Azzad’s proxy voting guidelines.)

Donating to provide humanitarian aid to suffering people is an important part of crisis management, and of course we hope people will continue to do that for the Rohingya. But we also want to draw attention to ways people can use their investment dollars to do some good in the world. Pressing corporations not to do business with suspect regimes is one concrete way to do just that.