Did you know that Azzad’s portfolio managers start with a smaller investable universe than most conventional money managers? That’s because we apply halal investing or Islamic investment screens to the investable universe before each manager even begins his or her investment process.

This screening eliminates nearly all financial and utilities stocks. It also eliminates companies with greater than 30% debt compared to market capitalization, as well as other financial ratios. Halal portfolios are generally more weighted in the information technology and healthcare sectors with little to no exposure to financials. As a result, the performance of a halal portfolio may be different than that of a conventional portfolio.

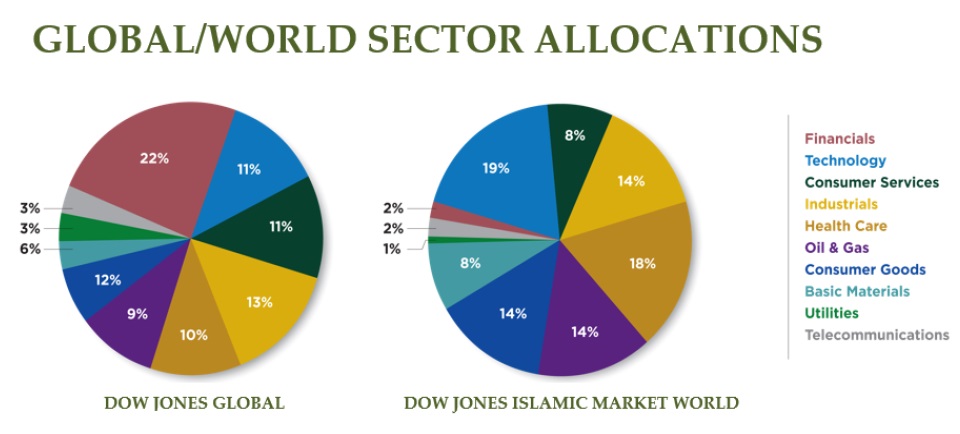

Below is the Dow Jones Global Total Stock Market Index, which is a total portfolio index with exposure to major market sectors. Besides it is an Islamic version of the same index. Although this is not an Azzad portfolio (and it’s not possible for anyone to invest in an index), it can give you an idea of how our products might look in comparison to their conventional counterparts.

The most glaring difference between these pie charts is the relatively small exposure to financial services in the Islamic index compared to the traditional index. This is to be expected, of course, due to the Islamic prohibition against riba, or interest. This is also a significant observation as financials are the top asset class in the traditional global index, with a 22% allocation. Due to the lack of broad representation of financial services in the Islamic index, other industries are more heavily weighted.

Based on this, one would expect the Islamic index to be negatively correlated with the performance of financial services. The Islamic index should outperform the conventional index when financial services underperform relative to other sectors, and vice versa.

Over shorter time frames this appears to be the case.

Examples of Short-Term Underperformance Due to Financials

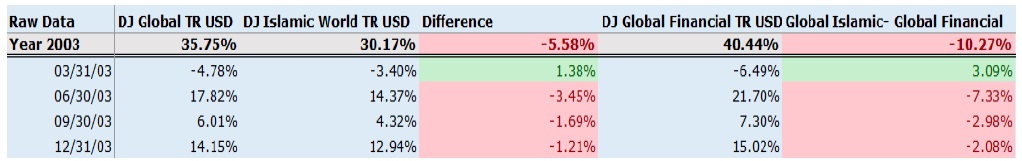

In 2003, the Dow Jones Islamic Market World Index underperformed the Dow Jones Global Index, returning 30.17% versus 35.75%. The major driver of this underperformance can be attributed to the financial services sector within the conventional index, which returned 40.44%:

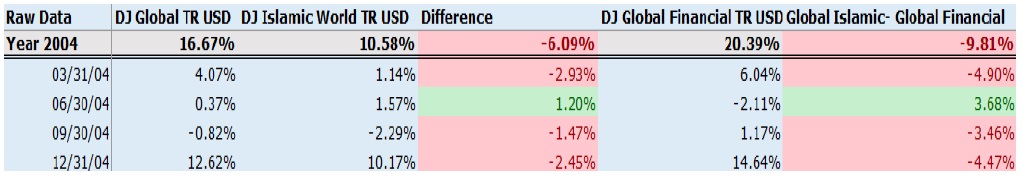

The following year (2004) produced a similar result. Despite a relatively solid 10.58% return for the Dow Jones Islamic Market World Index, the Dow Jones Global Index rode the strength of financials to an even higher return—16.67%. Once again, financial services accounted for the majority of the conventional index’s outperformance:

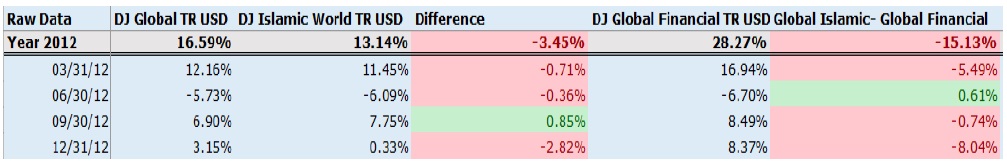

More recently, the trend continued. Following a dramatic selloff in the wake of the Financial Crisis, financial services rebounded, accounting for a significant share of outperformance in 2012:

If you’re currently invested in Azzad’s portfolios, it’s possible you’ve seen some underperformance relative to the benchmarks because of the recent boom in financials once again. That’s how markets sometimes work.

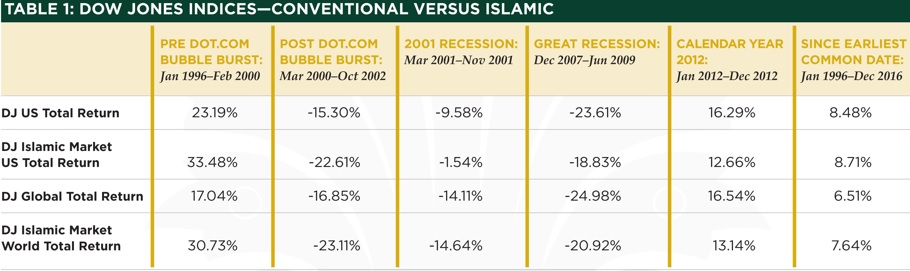

The table below takes these two indices and pits them head-to-head in other markets. Take the Great Recession, for example, when financial services was the hardest-hit sector. Returns for the Dow Jones Global Index (shown below) are in the in the third row. It returned -24.98% during that period versus the Dow Jones Islamic Index, which returned -20.92%. Yes, the Islamic index fell, but by about 4 percentage points less than its conventional counterpart. This is mostly because the Islamically screened index is less exposed to financials.

Let’s zoom out, though, and take a look at the long term. Below is the conventional Dow Jones Global Total Stock Market Index (the blue line in the graph) versus the Islamically screened Dow Jones Islamic Market World Index (shown in reddish brown). We compared their performance over the last 20 years. At the end of that period, the Dow Jones Islamic Market World Index outperformed its conventional counterpart with an annualized return of 7.28% versus 5.93%.

The bottom line: halal screens can help performance, depending on sector trends. Longer term, applying them can be advantageous financially as well as spiritually.

No strategy, including halal or Islamic investing, can guarantee a profit or protect against a loss. Investing involves risk and you may lose money.