Dividend Portfolio

We manage our dividend portfolio in-house at Azzad.

Part of the Azzad Ethical Wrap Program

A comprehensive halal wealth management solution for high net worth clients, organizations, and business owners.

Quick Links

Performance

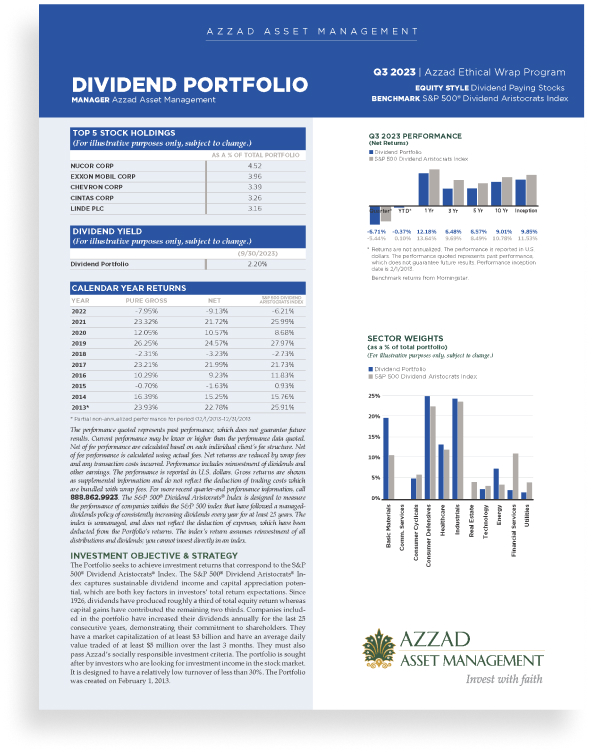

Quarter and year-to-date returns are not annualized. GIPS performance inception date is 1/1/2013.

GIPS performance inception date is 1/1/2013. The performance is reported in U.S. dollars. The performance quoted represents past performance, which does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Net returns are reduced by all fees, transaction costs and are gross of foreign withholding taxes. For more recent quarter-end performance information, call 888.862.9923. The S&P 500® Dividend Aristocrats® Index is designed to measure the performance of companies within the S&P 500 index that have followed a managed-dividends policy of consistently increasing dividends every year for at least 25 years. The index is unmanaged, and does not reflect the deduction of expenses, which have been deducted from the portfolio’s returns. The index’s return assumes reinvestment of all distributions and dividends; you cannot invest directly in an index.

Top 5 REIT Holdings

as a percentage of the total portfolio

Nucor Corp 4.52

Exxon Mobile Corp 3.96

Chevron Corp 3.39

Cintas Corp 3.26

Lince plc 3.16

As of 9/30/2023. For illustrative purposes only; subject to change. Model portfolio holdings and allocations are subject to change and are not a recommendation to buy or sell any security.

Sector Weights

as a percentage of the total portfolio

As of 9/30/2023. For illustrative purposes only; subject to change. Figures may not equal 100% due to rounding.

Why Dividend Investing?

Dividends are payments that companies make to their shareholders on a regular basis, usually once per quarter.

Dividend payments are usually made in cash and represent a portion of the company’s profits, which investors earn as shareholders in that company.

Companies still focused on growing might choose to invest profits back into the company to fuel its expansion rather than paying dividends. Companies that pay dividends are usually more stable, established businesses with consistent cash flow.

If you’re interested in investing in dividend-paying stocks but want to make sure you avoid companies that deal in unethical business activities, consider Azzad’s dividend portfolio as a socially responsible way to track a dividend index.

Meet the Manager

Azzad Asset Management is a registered investment adviser headquartered in the suburbs of Washington, D.C.

Azzad is committed to managing clients’ money according to a socially responsible investment philosophy based on faith-based values and incorporating a rigorous and disciplined investment approach.

Azzad believes that companies operating in ethical lines of business offer relatively less business risk and are in a better position to thrive in the long-term.

The firm’s proprietary screening process allows the manager to prudently manage client assets in a manner consistent with their values.

Objective & Strategy

Azzad’s dividend portfolio seeks to achieve investment returns that correspond to the S&P 500® Dividend Aristocrats® Index after screening for Azzad’s ethical screens.

This portfolio is passively managed according to its benchmark.

The S&P 500® Dividend Aristocrats® Index captures sustainable dividend income and capital appreciation potential, which are both key factors in investors’ total return expectations. Since 1926, dividends have produced roughly a third of total equity return, while capital gains have contributed the remaining two thirds.

Companies included in the portfolio have increased their dividends annually for the last 25 consecutive years, demonstrating their commitment to shareholders. They have a market capitalization of at least $3 billion and have an average daily value traded of at least $5 million over the last 3 months. They must also pass Azzad’s socially responsible investment criteria.

The portfolio is sought after by investors who are looking for investment income in the stock market. It generally holds fewer than 40 U.S. domestic stocks and is designed to have a relatively low turnover of less than 30%.

Inception date: January 1, 2013

Asset class: Dividend-paying stocks

Portfolio manager: Azzad Asset Management

Benchmark: S&P 500® Dividend Aristocrats Index®

Azzad Ethical Wrap Program minimum investment: $500,000

For more information: 888-862-9923

Investment Process

When building this portfolio, Azzad screens the companies in the S&P 500® Dividend Aristocrats® Index through its proprietary halal investing software, first removing stocks with unacceptable primary business activities.

The remaining stocks are evaluated according to several financial ratio filters to remove companies whose debt or interest-income run afoul of halal screens.

Access This Strategy

Our dividend portfolio is offered through the Azzad Ethical Wrap Program.

The minimum initial investment for the program is $500,000.

If you’d like to learn more, please contact us and one of our financial advisors can help you decide if the wrap program is a good fit for your needs.

Important Information

Investing in dividend yielding stocks could fall out of favor and returns would subsequently trail returns from the overall stock market.

Investments in securities involve risks and there is no guarantee that a strategy will achieve its objectives. As with all stock investments, you may lose money investing in a portfolio. Azzad’s portfolios generally avoid companies in certain economic sectors and businesses due to Azzad’s socially responsible investment restrictions. Therefore, their performance may suffer if these sectors and/or businesses outperform the overall stock market.

Each portfolio is nondiversified and may invest a larger percentage of its assets in fewer companies exposing it to more volatility and/or market risk than a diversified portfolio. Each portfolio is generally available only through one of Azzad’s asset allocation strategies and is not designed by itself to be a comprehensive, diversified investment plan.

All of Azzad’s models are actively managed. Active trading of securities may increase your account’s short-term capital gains or losses, which may affect the taxes you pay. Short-term capital gains are taxed as ordinary income under federal income tax laws. When reviewing your actual performance, holdings and asset allocation, note that different accounts, even though they are traded pursuant to the same strategy, can have varying results. The reasons for this include: i) the period of time in which the accounts are active; ii) the timing of contributions and withdrawals; iii) the account size; iv) the minimum investment requirements and/or withdrawal restrictions; and v) the actual fees charged to an account. There can be no assurance that an account opened by any person will achieve performance returns similar to those provided on this page.

You should consider investing in the Ethical Wrap Program if you are looking for long-term returns and are willing to accept the associated risks. The Ethical Wrap Program is made available through a Wrap Brochure which contains important information about our firm, strategies, risks and conflicts of interest. Please request a copy of our Wrap Brochure, Part 2A of the firm’s Form ADV and your representative’s Part 2B by calling 888.862.9923 before investing in the Wrap Program or opening an account with us.