Ehab Alalfey

Azzad Investment Advisor

It’s been more than a year since the coronavirus pandemic began. While there remain many unknowns, let’s reflect on 10 lessons investors should have learned from 2020.

If we could have somehow warned you that a pandemic was going to trigger a steep economic decline, including a stock market crash last year, you would have spent the entire year in cash, right? Odds are you’d still be in cash. Having missed out on historic gains, you’d be waiting for the next crash. That is Lesson #1: market predictions are useless. If, by luck, you’re partially right, you’ll still have trouble profiting from them.

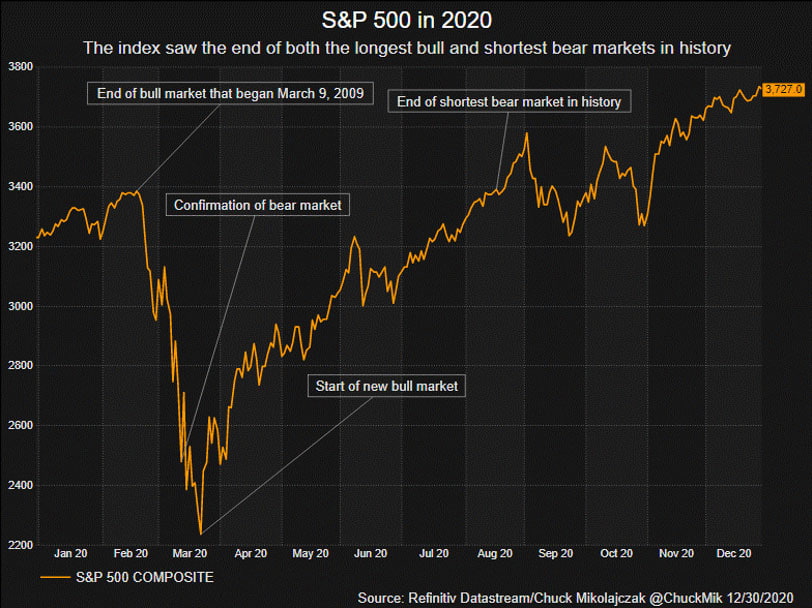

Lesson #2: Historically, every market crash has been completely erased by a bull market rally. Last year was no different. On March 23, the global shutdown caused all three major market indices to drop more than 30% from their previous peaks. While the media pundits on CNBC predicted gloom, it took less than five months for the S&P 500 to hit a new all-time high from its bottom.

As the chart below illustrates, the S&P 500 soared 76%, making the past year one of the best 365-day stretches since Word War II. Lesson #3: Every crash or correction presents a huge buying opportunity for long-term investors. Lesson #4: Time is more important to your financial success than a crystal ball.

While those of us at Azzad cannot predict when the next crash (or correction) will occur or, how long it will last, or how steep the decline will be, we can guarantee that the markets will go haywire again. The stock market has undergone 38 corrections since 1950. That’s a correction (defined as a 10% drop), on average, every 1.84 years. Overall, the average correction (since 1950) has lasted about 6 months. Lesson #5: Market volatility is the price you pay for investing. Instead of fearing it, embrace it.

Think back to March 2020. If you could not sleep well that month, then you will not be able to the next time a selloff happens. Far too many investors allow FOMO (fear of missing out) to control how and when they invest. Your equity exposure should be what allows you to sleep peacefully at night. As the markets soared in the past few months, investor appetite for risk has increased. Short-term market performance should not dictate your appetite for risk. Lesson #6: Find the right asset allocation for your emotional well-being and then stick to it.

If it is not clear by now, time is a critical ingredient to be successful in the markets. We cannot tell you how many people’s time horizons suddenly dropped to zero last year. As humans, we are wired to respond to stressful situations with a “fight or flight” physiological response. When the markets are declining, we feel a strong urge to stop the terrible feelings by selling. Keep in mind Lesson #7: Every good feeling you get from gains will get erased by the terrible feelings from declines. Lengthen your time horizon and the effects of loss aversion slowly start to fade away.

The last 12 months was a reminder of what we can and cannot control. Ultimately, it is how we behave in a panic that will determine our success in the markets. No amount of technical analysis, charts or rationalizing will keep you from jumping ship. That is Lesson #8: The world is a crazy place. Do not let the craziness knock you off your course. Stick to your investment plan.

I’m the first to admit the past 12 months have been scary. For me, it helped to talk to my colleagues and listen to our portfolio managers. I also relied on my faith and took solace from the fact that my investment plan was built to survive. Your financial planner/advisor is your behavioral finance coach. It’s their job to remind you of all the statistics I previously cited. Lean on them when you’re feeling anxious about the markets. But, don’t forget why you hired them. That is Lesson #9: Listen to your advisor, who should remind you to stick to your investment plan even when the sky seems like it’s falling.

Of course, it is easier to stay calm when others are panicking if you are prepared. A portfolio concentrated in a few technology stocks doesn’t’ lead to much confidence. On the other hand, a portfolio that is well-diversified, managed properly, and aligned with your personal benchmark is much better able to withstand market corrections. Now is the time to ask yourself: When the next correction comes around, will I be ready? That is Lesson #10: Be prepared.